Accounting is an integral part of managing a business.

It helps in creating and controlling the budget, making major purchase decisions, and also track expenses. Without accounting, your business will always remain a little deficient when it comes to growth.

However, accounting can be complicated and time-consuming. Sometimes business owners find it challenging enough to handle the bare minimum tasks like paying bills and keeping track of income, so answering critical questions like “Is my business profitable?” and “Can we make required tax payments?” is certainly out of the way.

Accounting is best done when handled by software rather than a human. Sure, having a real accountant on standby is great and necessary, but the major chunk of handling shall be done by software.

Using software can save you a massive amount of time and money while being legally sorted on the financial areas. It also helps you get a better idea of what’s your business’s standing by generating on-demand reports.

There are so many things which you wouldn’t have been able to do manually, taking “chance of errors” as an example. An accounting solution has little to no chance of errors.

To give you a better perspective of what to use, let’s have a look at the different ways to manage accounting. There are quite a few good ways to do it, and 3 of them are discussed below.

#1. Traditional software

There’s a ton of traditional software available that lets you do the heavy-work of accounting. You can download them to your computer/laptop and carry out the calculations. The good thing about this type of accounting is, you don’t necessarily need an active internet connection to use the software and access your data. Everything can be done offline.

However, that doesn’t make it the best option. It has its own drawbacks. In fact, everything has drawbacks, so you’d want to have a look at the below options as well.

#2. Hiring an accountant

As stated above, having an actual accountant on standby is quite necessary. But, should you entirely depend on them? That wouldn’t be ideal because there’s very little an accountant can do when compared to a full-blown solution.

An accountant shall only be used for:

- Having personal financial advice

- Having security when you don’t know what to do

- Outsourcing tiresome accounting tasks

If you keep your accountant just for these things, then it’s totally fine. Or else, you should opt for a cloud-based solution if you want more.

#3. Cloud-based solution

Probably the best choice to handle accounting, a cloud-based solution can massively ease the burden off your shoulders. Also, it has a lot of benefits and features attached to it, which will make you truly consider it. By using cloud-based accounting solution, you can:

- Save upfront on costs and on the long-run

- Save a massive amount of bandwidth on various fronts

- Access the solution from any device since it’s online

- Enjoy more security

Not to forget features like the ability to collaborate and automation of workflows. If all that sounds something you could use, then you’d love this list of cloud-based accounting solutions I’ve compiled below.

FreshBooks

One of the most popular in this list, FreshBooks is another amazing all-in-one invoicing and accounting solution that is widely used. You can automate a bunch of tasks, such as invoice reminders and collecting payments to save yourself some time and concentrate on areas that require your attention.

Other than that, you can:

- View detailed reports

- Enable various online payment options

- Collaborate with your team to improve workflow

- Use the solution on mobile as well

They have an award-winning support team that’s raring to solve your problems and doubts.

Patriot Accounting

A comprehensive and user-friendly accounting solution, Patriot accounting software aids organizations in streamlining their financial processes. It provides a range of tools to aid companies in efficiently managing their finances.

It is a cloud-based platform with a simple UI for Windows and Mac computers.

The software aims to give organizations a complete picture of their financial condition, including the ability to track revenue and costs, and accounts receivable and payable.

The accounting software from Patriot has features for organizing payroll, tracking inventories, and more. Additionally, the software provides a range of reports to assist firms in monitoring their financial success.

Top Features

- Supports unlimited invoices, unlimited payments to vendors, and numerous clients.

- Import existing clientele, accounts, vendors, and other details

- Dual ledger accounting allows for multiple accounting views

- Reconciliation of bank accounts up to 8 level sub-accounts

- Free expert assistance from the USA

- Drill down financial reports without having to navigate away from the page.

- Accept credit card payments and establish reminders for invoices.

The software can be tried out for free for 30 days and then upgraded to one of its two subscription-based pricing models, Basic or Premium, later.

NetSuite

NetSuite cloud accounting software simplifies the management process of your finances. It seamlessly offers both finance and accounting functions. So, you can have increased financial close efficiency, strong compliance management, better business performance, and fewer back-office expenses.

This software is also capable of tracking all transactions, managing debit and credit, collecting taxes, and providing you with accurate reporting. Moreover, you get real-time access to your financial data for statement generation, compliance disclosure, and many more.

NetSuite accounting software can be accessed from anywhere and at any time. You can also use it to automate your repetitive financial tasks. Payment management, fixed asset management, close management, and cash management are other things you can do with the help of this software.

Zoho Books

A solution with some power-packed features, Zoho Books has been a prominent name in the industry for a long now, and they’ve always been stepping up their game. By using this software, you can manage your finances, automate business workflows, and also collaborate with your team members to work collectively.

It can look after a variety of tasks, such as invoicing, negotiating deals, and raising sales orders. Also, if you’re from India, you can be compliant with GST as well.

Since the requirement grows over time, Zoho Books allows you to integrate over 40 apps in order to manage every aspect of your business.

Quicken

Highly praised by PCMag, Quicken offers a variety of features to seamlessly manage your finances. You can stay on top of your spending by seeing the amount that is left after the bills are paid, and make precise money decisions with their custom budgets.

You can set alerts about due dates and manage your bills effortlessly. Other than that, Quicken is great for tracking investments, as it helps you review your portfolio, monitor performance, and see market comparisons.

Most importantly, your data is secured with 256-bit encryption.

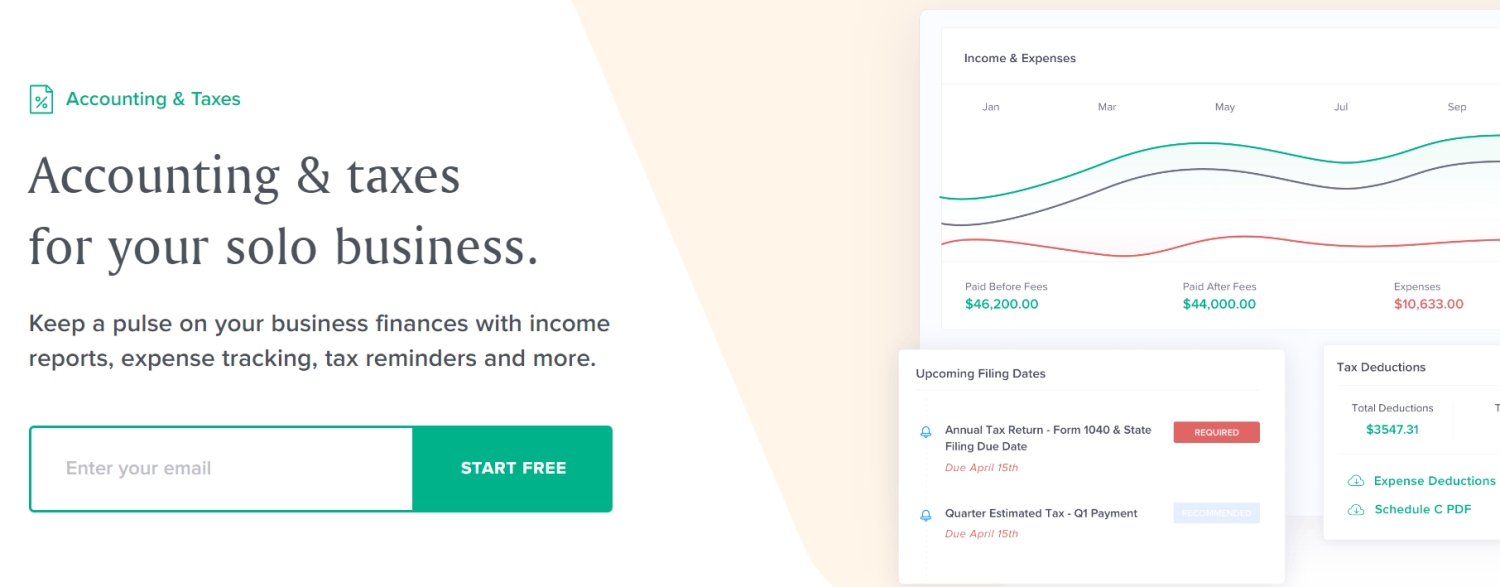

Bonsai

Bonsai is an Accounting and Taxes solution ideal for a solo business. It lets you keep a track of your business’s finances such as expenses, income reports, tax reminders, and much more.

It lets you:

- Import your expenses automatically save your taxes while filing

- Keep a track of your profit or loss along with the totals of your income and expenses

- Offers you quarterly or annual tax reminder

- Keep track of the number of hours you work on a project

- Offers you contract templates approved by several contract attorneys

With Bonsai’s accounting and tax solutions, you can rest assured that you will never miss your upcoming tax payment. You can start with its 2 months free trial. After the trial, you can choose the plan as per your requirement.

Wave

You can take care of accounting, invoicing, and receipt tracking with Wave. Without the need to do any data entry, you can generate financial reports and keep track of financial numbers. You can automate almost every single task and even integrate with other Wave products, like payroll and payments.

Their invoicing feature allows you to create and send professional invoices in literally minutes. You can charge on a recurring basis or even automatic. The best part? No trace of their branding on your invoices.

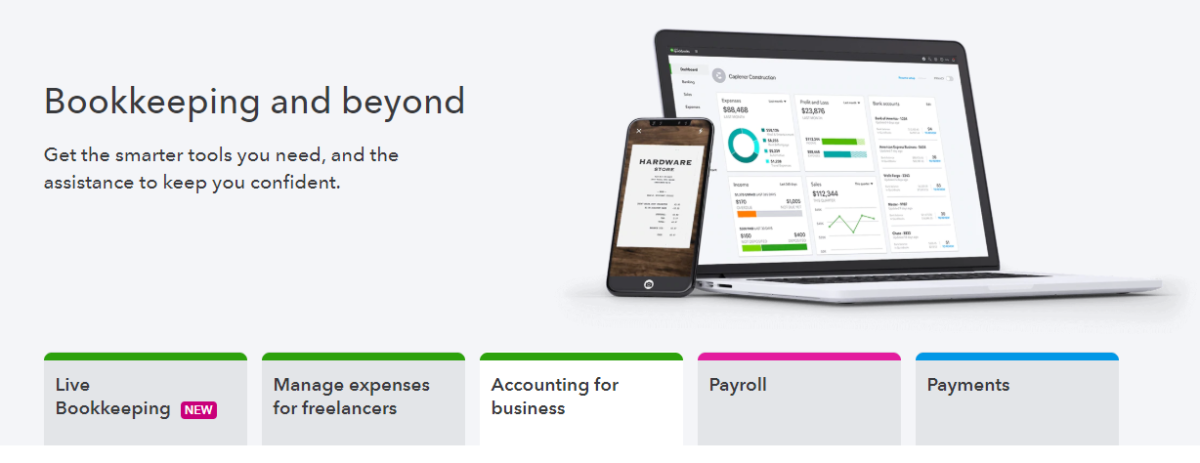

Quickbooks

Though every single solution in this list is great for non-accounting types, Quickbooks is a tad bit more suitable for every person out there. Everything is super organized and within close reach. On top of that, you get easy-to-read reports and dashboards.

You can connect your bank account and cards to easily import and sort expenses into appropriate categories. Syncing with popular apps is also just a click away.

You get invoicing and all the required tools to better manage your accounting. Not to mention, customers of Quickbooks find an average of $3,534 in tax savings per year.

Xero

Integrates with over 800 apps, Xero can help you maintain great financial health of your business. You can use this solution from any device and run the work on the go. From easy reconciliation, creating invoices and expense claims, there’s a lot of stuff you can do with this.

Talking about the “reconcile” feature, it lets you import and categorize your latest bank transactions into Xero and easily take accounts of them. You no longer need to add them manually to each section to determine where they belong and whether to calculate them or not.

You can get started with their 30-day free trial.

Kashoo

You can organize a whole year’s worth of expenses in a jiffy with Kashoo. It has a “smart inbox” feature that separates personal and business data and helps you get ready for taxes. The most impressive thing is, their AI technology will learn your business and make manual expense tracking history so that you don’t have to do it.

Not to mention, analyzing your reports and creating invoices is just a breeze. You can sign up for free and enjoy a plethora of features as well as a great support team.

LessAccounting

You can do everything with LessAccounting that you’d do with other solutions out there, but with a little less effort. It’s a software that works hard for you so that you don’t have to. 😉

You can get started instantly and connect your bank account to see all your transactions automatically appear in your bookkeeping, without entering receipts manually.

Apart from that, you can create recurring billing, manage invoices, and accept payments quicker. All those invoices that are paid will automatically be added to your accounting records. Go ahead and try your first month free.

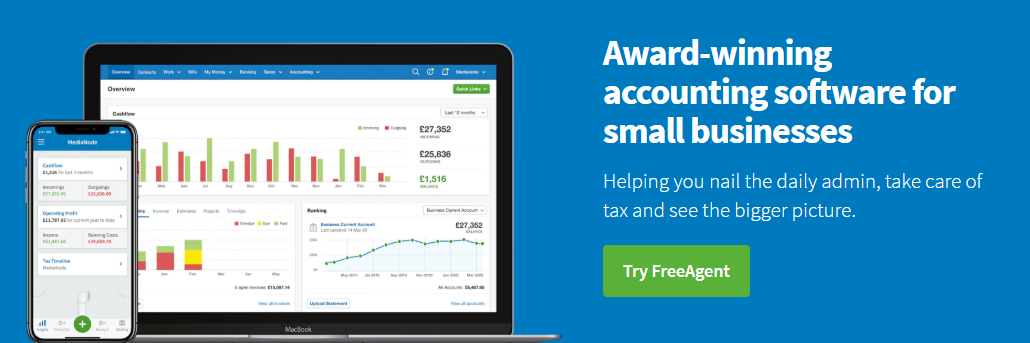

FreeAgent

Rated 4.5/5 stars on TrustPilot, FreeAgent can help you stay on top of your tax, manage expenses, and create invoices instantly. It has a very tidy dashboard, so you know exactly what you want to work on. Also, you can get automatic tax forecasts and reminders.

They have great UK-based support accountants to guide you whenever needed. Getting started is free. No credit card required.

Chargebee

Chargebee will always keep you in line with the latest tax rules, be it compliance requirements or EU-VAT complications. In fact, by using this solution, you can comply with GAAP & IFRS to easily blend your SaaS Accounting with the ever-changing finance department.

Moreover, you can integrate and sync Chargebee with a bunch of other apps to further streamline your accounting. It lets you constantly keep an eye on the forecast as well, helping you get a better idea of the latest curve.

There are a lot more features waiting to be utilized, so be sure to check them out and see if it’s the right fit for you.

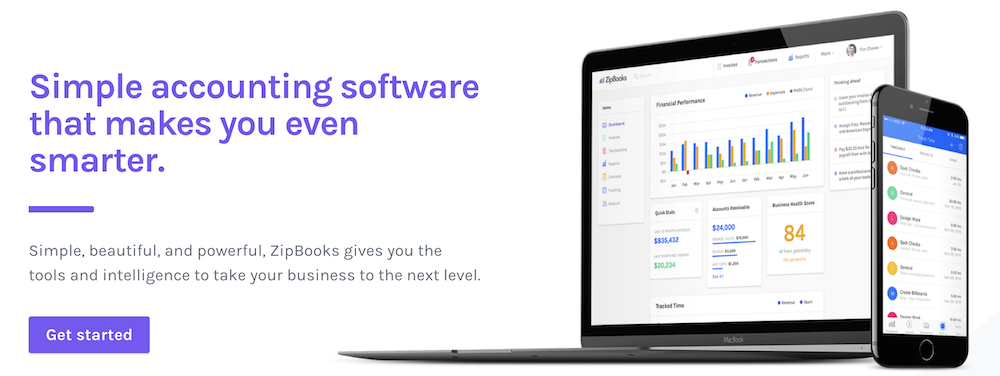

ZipBooks

Simple yet effective, ZipBooks is mashed with features that you didn’t know you needed. For example, you can invite your customers to leave reviews after getting paid. This helps in building your online presence and attracting more customers.

You can create invoices with auto-billing and even set reminders. Bookkeeping and reporting get smarter with ZipBooks, as you can use simple-reconciliation, color coding, auto-categorization, and a whole suite of reports.

ProfitBooks

Great for people with little to no accounting knowledge, ProfitBooks is simple and growing rapidly in the market. You can create gorgeous invoices, track expenses, and manage inventory. After that, you can easily share the data among your team members if required.

This solution is 100% free to use and comes with three different-language chat support, which is mind-blowing. No limitations, no hidden fees, and no strings attached.

Sage

With over a 3 million customer base, Sage allows you to manage accounting, finance, people, payroll, and various aspects of your business. You can access the departments from any device and take care of a bunch of areas all within one cloud solution.

If you’re a fan of keeping everything in one place, I believe you’re going to love Sage. They’ve won several awards over the years for their great service, so you’d definitely want to check it out.

How do you choose cloud accounting software?

It is very important to have a balance between cost considerations and features to ensure the platform runs efficiently for your business. A user-friendly interface and seamless integrations would help you ensure everything is up-to-date and running seamlessly as your company grows.

Below are some factors through which you can shortlist the best cloud accounting software for your organization.

- Ease of use: Software should have an easy-to-navigate and user-friendly interface. With minimal training required, your team can start working with no fuss.

- Robust security: A professional cloud accounting provider delivers data security with multi-factor authentication, user access control, auditing, and compliance with local regulations. Some vendors even provide data localization if required for secure regional storage.

- Scalability: The software can flexibly adapt to your expanding needs, from managing inventory and accessing reports remotely to scaling operations such as adding more workers.

- Pricing: Cloud accounting services are often available with pay-as-you-go models, so it is essential to carefully consider your business’ needs and evaluate the level of service provided and the associated fees.

- Migration: Cloud service providers assist businesses with data migration, running applications on the cloud, and managing changes, thus ensuring seamless integration of systems. If you are totally new to cloud services, then you should opt for such a service provider.

- Mobile accessibility so that users can use it on the go.

- Essential features that are essential for most organizations are listed below, but you can access your own needs based on your organizational environment: Automatic data backup, Time tracking, Payroll capabilities, Customer relationship management (CRM) integration, Multicurrency support, Budgeting dashboards, Tax information management, Ability to create purchase orders (POs), Ability to handle bill payments and Invoicing, etc.

- A powerful software offering multiple user access with flexible and secure control is ideal for all teams who need to collaborate efficiently.

- Data backup and recovery feature is essential in case of any disaster.

Shifting to cloud accounting software is an easy and straightforward process. To make the most of this transition, select a solution with an intuitive management system combined with reliable services from trusted providers that offer consistent performance without any downtime – all you need for your business success.

FAQs

Many of the cloud accounting software vendors offer, among other features, continuous updating of their software to ensure that they are compliant with ever-changing tax regulations. Nonetheless, it is still a matter of keeping updated about the latest tax regulations within your country and also ensuring you use your cloud accounting software correctly.

Cloud accounting software takes care of businesses with international operations in the following ways for multi-currency transactions:

Automatic Currency Conversion: Cloud accounting software provides automatic currency conversion as per real-time data, considering the latest exchange rates.

Transaction Recording: Users can record a transaction in any currency and specify currencies used while recording it, which will be converted into the desired report currency according to current exchange rates.

Integration: It should also integrate well with other business systems like e-commerce or CRM systems so that all such multi-currency transactions are properly recorded between these systems without repetition.

Most cloud accounting software provides insights into key financial ratios and performance metrics such as profitability, liquidity, leverage, and efficiency ratios.

Yes, you can generate financial forecasts and projections for your business growth using cloud accounting software by feeding historical data of revenue, expenses, and cash flow.

Conclusion

I am certain your accounting will get a whole lot easier by using these cloud-based solutions. In fact, you’ll be saving a lot of time, money and energy too.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones

![16 Best Cloud Accounting Software for Small to Big Businesses [2023]](https://cryptoshitcompra.com/wp-content/uploads/2023/09/1696061696_16-Best-Cloud-Accounting-Software-for-Small-to-Big-Businesses-850x550.jpg)