Expense Tracking is the process of making notes of where your money is going.

How frequently do you track your expenses?

Hourly, daily, monthly, quarterly, or yearly? It might seem like a tremendous amount of work at first, but you will understand its importance with time.

Taking care of our financial resources is of utmost importance, and it starts right from your college days. For some, it begins even before that. These days it only takes one medical bill, which may bring people on the verge of bankruptcy.

Tracking expenses monthly and yearly is the recommended method for business owners and individuals. This can become much more hassle-free with one of the expense tracking software listed below. You can find more details on the same in the post that follows.

| Product Description | Description | |

|---|---|---|

|

Zoho Expense |

Currency support, mileage tracking, 14-day trial. |

Explore |

|

Pleo |

Expense management with Pleo cards, spending limits. |

Explore |

|

Emburse Spend |

Streamlined team expenses, automated tracking. |

Explore |

|

Wallester |

Virtual payment cards, real-time tracking, free trials. |

Explore |

|

Payhawk |

Real-time tracking, automate expense processes. |

Explore |

|

Precoro |

Workflow automation, insights, integrates with tools. |

Explore |

|

Divvy |

Credit funding, real-time tracking, free to use. |

Explore |

|

FreshBooks |

Bank integration, receipt data extraction, automation. |

Explore |

|

Mint |

.Personalized spending tracking, budget adherence. |

Explore |

|

Expensify |

Unlimited receipt records, automatic scanning. |

Explore |

|

Bench |

Virtual bookkeeping, monthly financial statements. |

Explore |

|

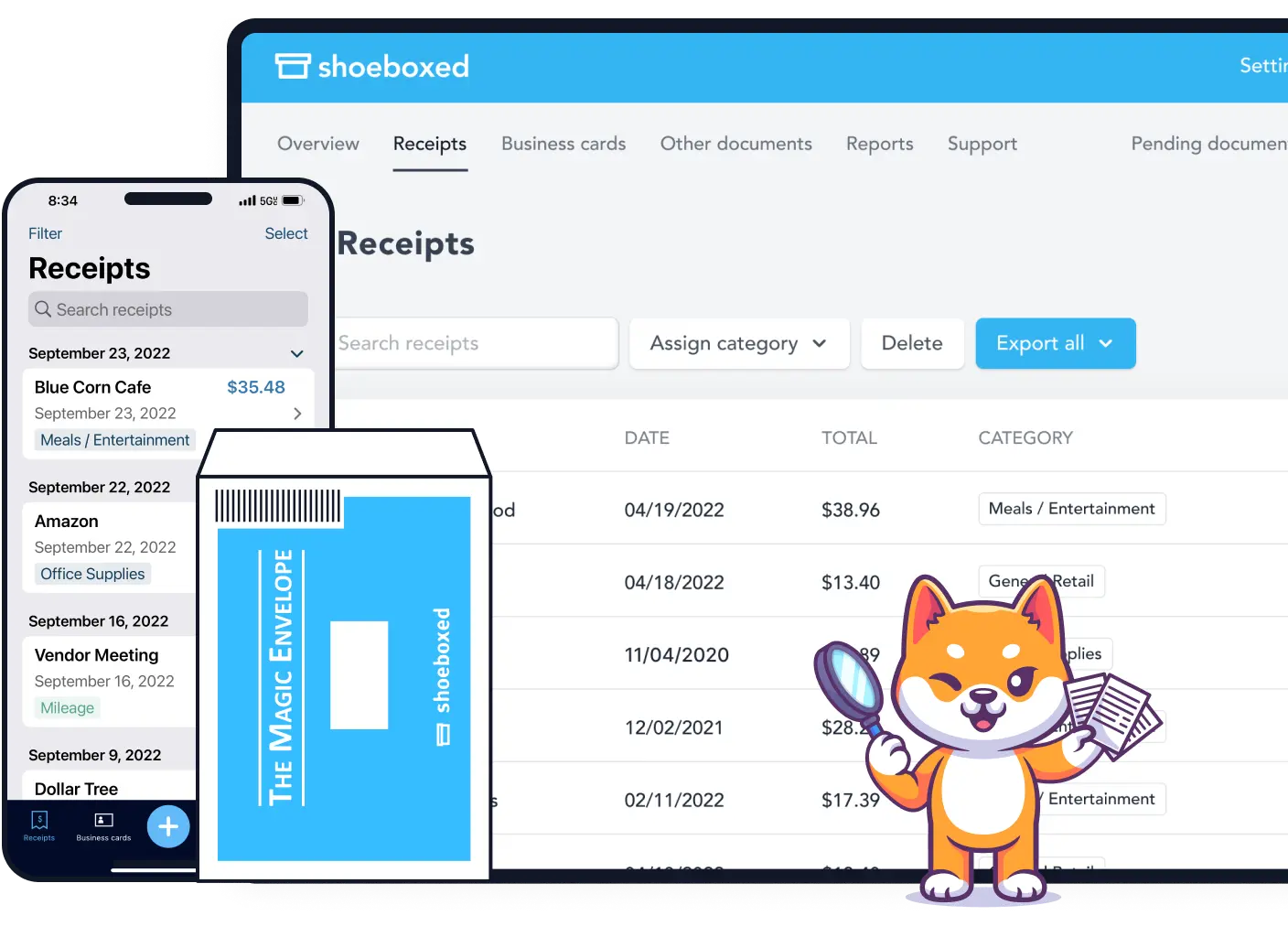

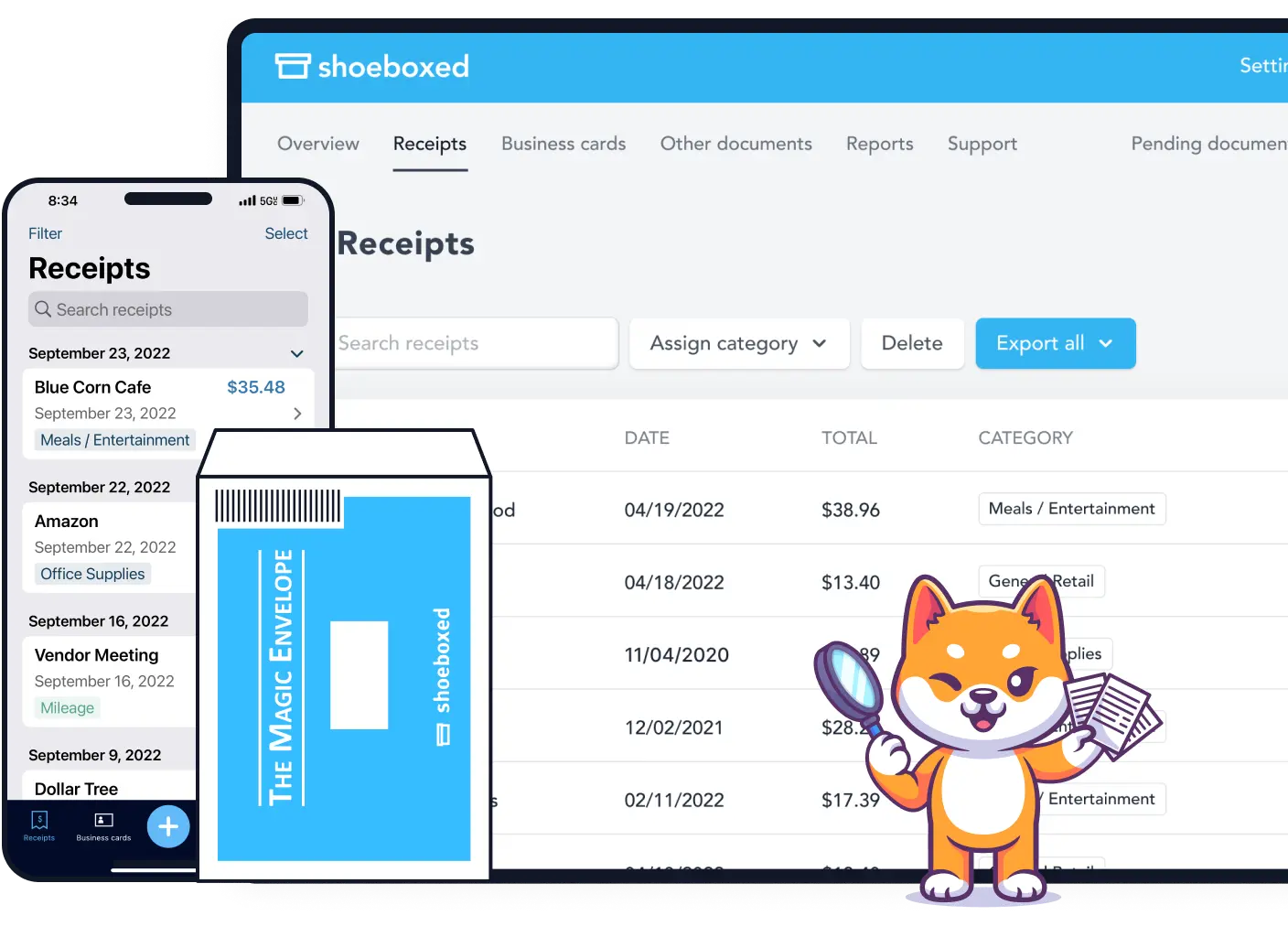

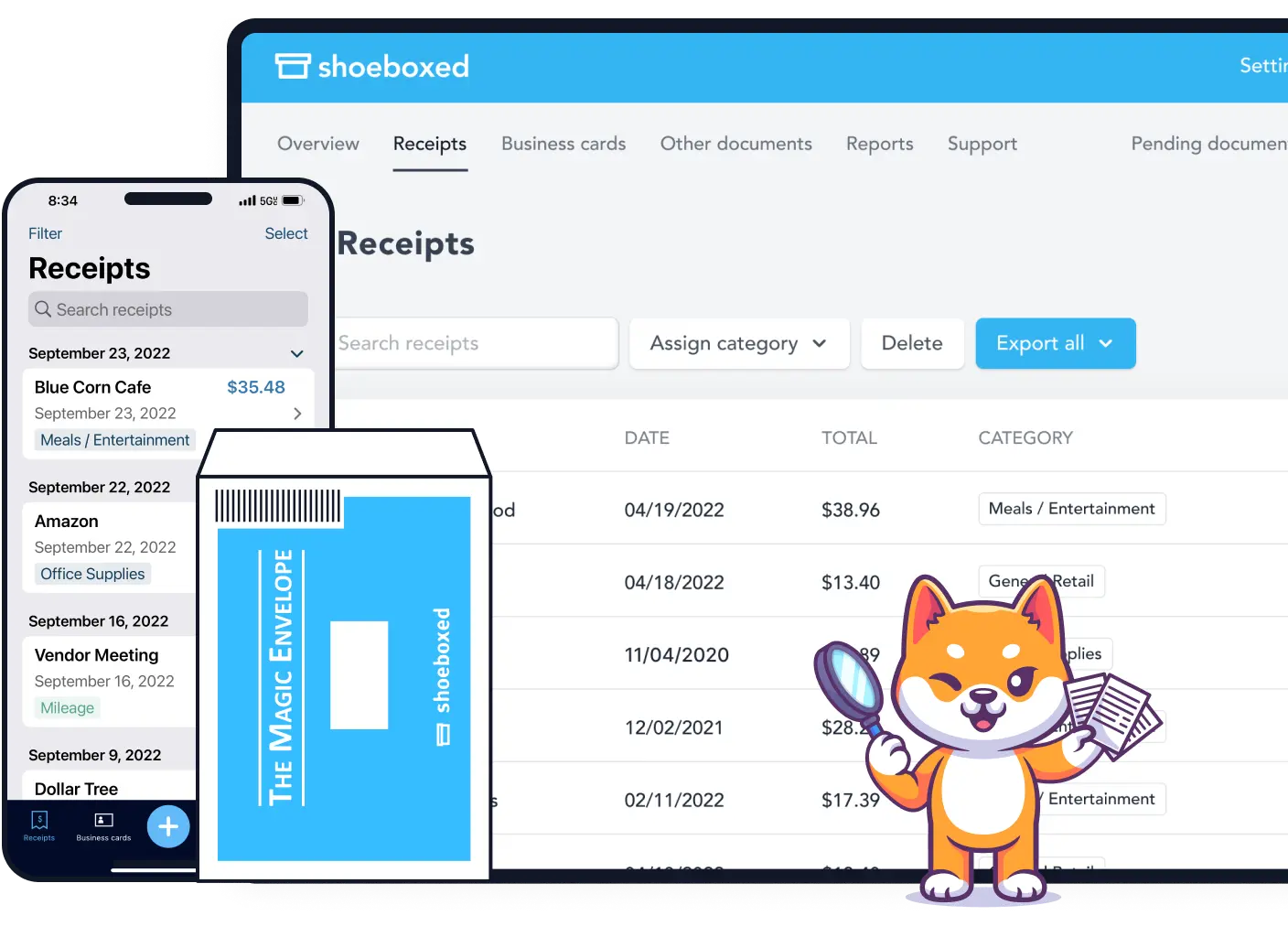

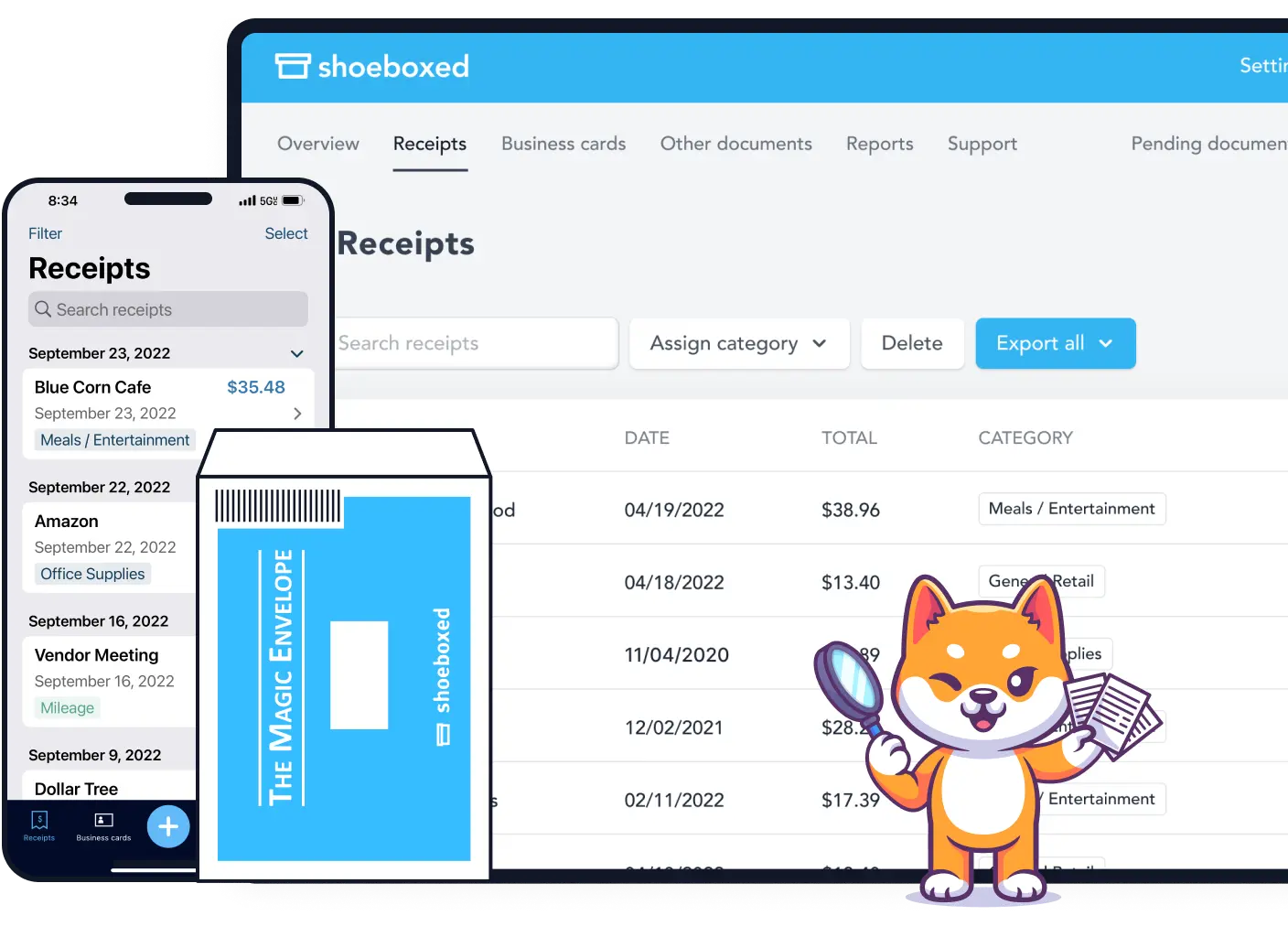

Shoeboxed |

Receipt digitization, expense reports, mileage tracking. |

Explore |

|

Dext |

Paperless expense tracking, 95%+ accuracy, integrations. |

Explore |

|

Concur |

ROI calculation, budget control, accessible dashboard. |

Explore |

|

Certify |

Report creation, multi-language support, integration. |

Explore |

|

MMC Receipt |

Receipt scanning, unlimited cloud storage, approvals. |

Explore |

|

Everlance |

Expense automation, tax deduction suggestions, customer support. |

Explore |

|

Wave |

Real-time profit/loss tracking, free and easy to use. |

Explore |

|

Veryfi |

Automated expense estimation, 24/7 availability. |

Explore |

Importance of Expense Tracking

- Sustain Spending Habits: Expense tracking will help you identify, limit, or eliminate your wasteful spending habits. It will further help you put your money where you need to.

- Preventing Overspending: Expense tracking will prevent blatant overspending by forcing you to create a monthly budget. Spending your earnings according to the budget set by yourself comes in handy in the long run.

- Control over Finances: If you constantly in debt, it is probably because you don’t control your expenses. Tracking expenses will give you the freedom to put your money into productive things.

Let’s say you went shopping with your friends during the weekend. You then realized you ended up buying things you did not want. You did it just because of peer pressure. Instead, investing that money in yourself by purchasing a self-help book or enrolling in some hobby class might have been helpful.

Also read: Best Expense Report Templates to Track Your Spendings

Why focus on Expense Tracking in Businesses?

It is essential for persons owning small and medium businesses to track expenses. Also, keeping personal costs separate from business ones is necessary since a company is an independent unit. Your business might be your passion, and it should be treated as such since:

- It will protect you from trouble: Your business is entitled to receive legal protection that you as a person might not. If your expenses are not separate, you contradict those offerings leaving yourself accountable if a client brings in a lawsuit. In that case, your assets may be at stake.

- It makes you ready for tax season: You will not have to look inside your cupboard or car dashboards for bills and receipts. Also, when you are traveling away from the city for a business meeting, you can claim a certain amount of expenses incurred. Some business costs are non-taxable and can be claimed as business meetings cost. Your bookkeepers’ job will also be easier as it will be simple to differentiate taxable things from non-taxable ones.

- Counting profits will become easy: You will be able to call out your profit numbers correctly without guesswork whenever clients ask. It will eventually help in maintaining the company budget by reflecting on expenses.

One way of tracking business expenses is by using business expense tracker apps. An expense tracker app helps you keep a timely and apt record of your spending by following receipts and bills. Some apps directly get linked to your bank and credit cards, saving you time by avoiding manual work.

Let us now look through some of the best expense-tracking apps for your business.

Zoho Expense

Zoho offers one of the best expense-tracking apps. Its UI/UX is very customer-satisfying, offering a wide range of solutions. Zoho guarantees to have no receipts untracked and digitally store them. You can also auto-forward your receipts via email. Even if your business is overseas, Zoho enables you to enter your expenses in different currencies.

Here, you can create a customized expense page and enable your employees to split expenses. If your business demands a lot of traveling, your mileage expense can be tracked with Zoho with 100% accuracy. This way, you can limit your costs.

It is compatible with any platform, including Android and iOS. Zoho offers beginners a 14-day free trial version.

Pleo

Pleo is a fintech startup that manages the expenses of businesses by using Pleo cards: credit and debit cards. You can organize your expenses by clicking a few buttons on the screen.

You can integrate Pleo along with other bookkeeping tools. It allows you to set your spending limits, customize them anytime, and suggest the best spending practices. Further, as soon as a payment is made from your Pleo card, you will get a notification, and that expense will be added.

Pleo is a go-to app for small and medium businesses and has three different pricing ranges. Pleo takes your load off from unmatched and tedious daily work and lets you focus on your business.

Emburse Spend

Emburse Spend features a robust and all-inclusive platform and convenient virtual cards, which is the perfect solution for transforming and managing your team’s expenses. Due to its intuitive controls to keep track of online and in-person spending habits, you can trust that all purchases are made with company guidelines intact.

Emburse Spend combines cutting-edge technology and professional expertise to facilitate approval and expense processes for organizations of any size and sector. Its tailored solutions provide customers with improved policy management, detailed insights into spending analytics, as well as enhanced payment capabilities.

Emburse Spend is the perfect solution for teams looking to automate expense reporting and tracking from start to finish and get rid of the tedious manual activities of managing expenses.

The approval process offers further security measures so that business owners can have an extra layer of control over their team’s expenses, allowing them to navigate dynamic changing landscapes while safeguarding operations confidently. Enjoy ultimate peace of mind knowing financial operations run smoothly and securely, thereby rationalizing purchasing needs within one centralized hub.

Its cards are designed to ensure controlling spend before it happens and simplifying reconciliation processes while monitoring various expenses such as marketing and advertising expenses, materials and supplies, plus travel and entertainment fees, among others.

Its pricing structure is designed according to the company size and features it opts for, so you need to get in touch with them for pricing details.

Wallester

Wallester is one of the most popular corporate spending tracking platforms. It offers a one-stop-solution for all business spending needs, like tracking, recording, payment method sharing, setting up new payment methods, and a lot more.

You can issue new virtual payment cards to your employees for corporate spending purposes anytime and anywhere. Its robust notification system always keeps you updated on real-time spending activities.

Furthermore, you can allow small cash withdrawals to replace the office petty cash lock box, which is highly insecure and inconvenient.

Being a business manager or stakeholder, you can exercise real-time decisions on purchases and spending by disabling the card from your end. Not to mention, you can also create virtual cards for specific projects and distribute access to multiple team members.

The developer is also working on a new feature called expense-proof tracking and uploading. This new expense tracking reminder system will remind the employees regularly to upload receipts, invoices, vouchers, etc.

The Wallester expense tracking tool works online via web browsers and on mobile phones and currently offering free trials. Hence, check it out to find out if this is the right expense monitoring tool for your business.

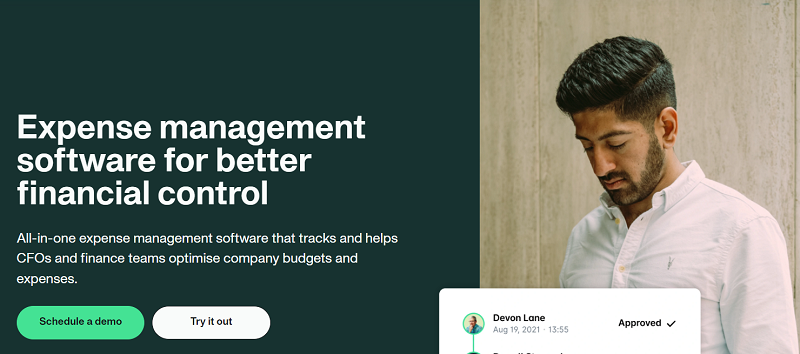

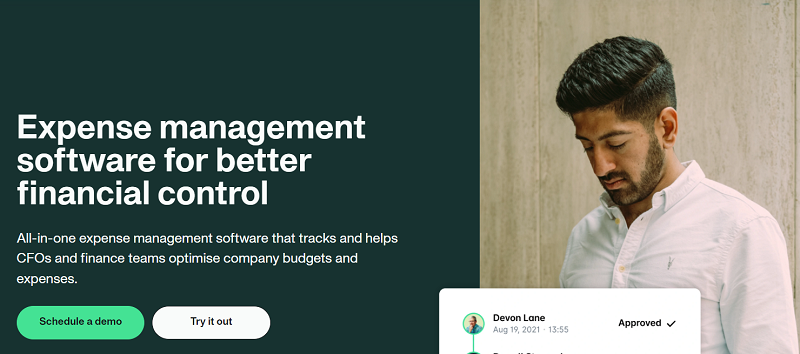

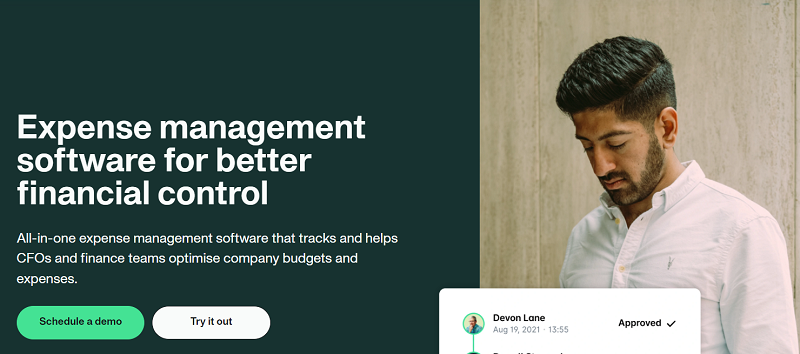

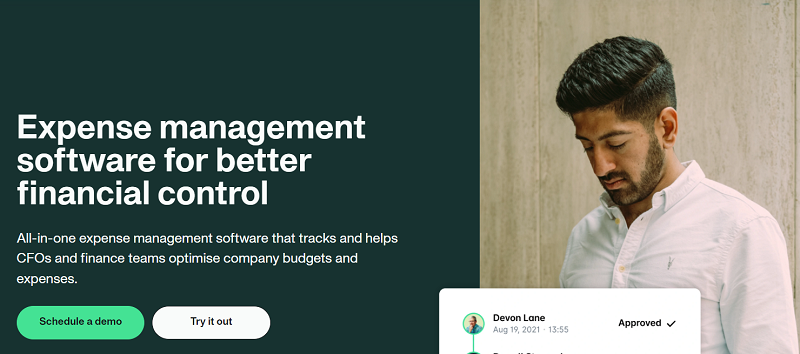

Payhawk

Payhawk is an award-winning expense management software that helps CFOs and finance teams optimize company budgets and expenses with real-time tracking of business expenses and transactions.

Payhawk expense management software automates and supports various spending processes such as company cards, reimbursements, employee expense management, supplier invoices, accounting integration, and subscriptions. It helps businesses clearly view their spending for better budgeting and cost control while streamlining accounting processes.

Payhawk automates tasks for businesses, including bank reconciliations and syncing transactions, saving time on receipt chasing by prompting users to attach receipts directly. It provides a unique IBAN for employee reimbursements, bill payments, and customizable fields to capture and segment expense data for valuable reporting based on projects and locations.

Payhawk’s mobile app automatically extracts receipt data and captures all expenses, including trips, mileage, and per diems, making expense management pain-free. Integrated bank transfers enable global employees to receive reimbursements easily, and the whole approval process is also automated.

Precoro

Businesses wanting to gain complete visibility of organizational spending can rely on Precoro. This efficient expense management software offers insights into operational expenses and ensures appropriate budget utilization.

You can automate the approval workflow with this software which will not only save your time but also save time to increase efficiency. Tracking invoices, receipts, and reimbursement requests becomes effortless with this platform. You can even integrate Precoro with your accounting tool for two-way data synchronization.

This software allows you to create rules for spending so you never exceed your budget. Its real-time dashboard is perfect for visualizing your overall spending. Moreover, companies can get in-depth reports on different categories.

To build a seamless workflow, you can integrate it with QuickBooks, Xero, NetSuite, Amazon Business Punch-in, and Slack. The pricing model is also fully-transparent and comes with a 14-day free trial.

Divvy

Divvy is an all-in-one expense management solution for your business. The platform has some unique features that make it the right choice for every business. With Business Credit, you can get access to funding of any size. You only need to apply for a credit line within a few minutes and start spending with the help of Divvy cards.

Expense management becomes pretty easy because you can categorize every purchase made with Divvy cards with a few clicks. So, there is no need for manual expense reporting in the company.

Once you build the budget for your company through Divvy, you can get real-time tracking and controls to take complete control of your company budgets.

The best thing about this world-class expense tracking software is that it is entirely free to use. There are no hidden charges. On top of that, you can get as many physical and virtual cards for your employees as needed. The rewards from Divvy for your spending make it another reason to choose this platform.

Say goodbye to traditional expense reports and say hello to this advanced expense tracking system.

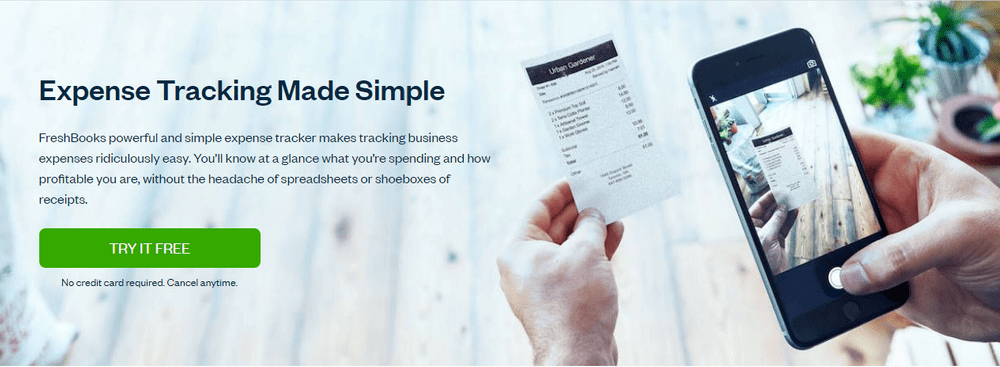

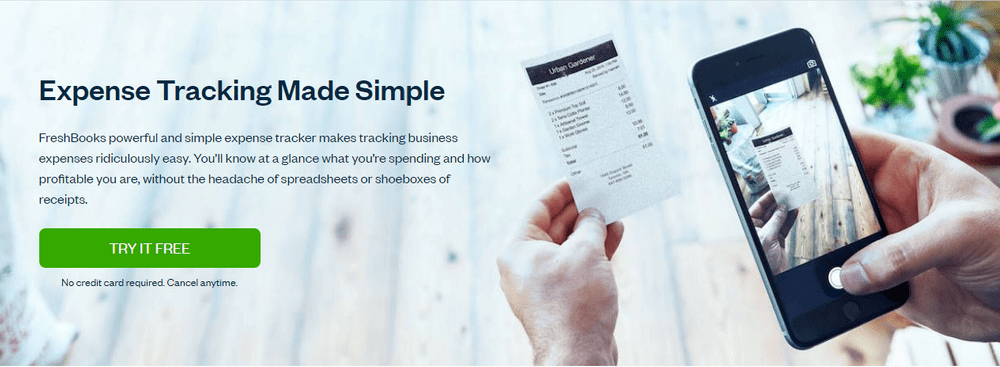

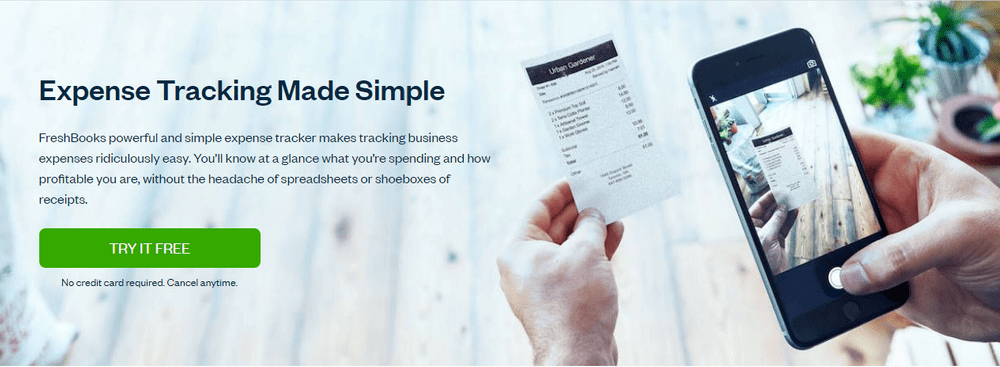

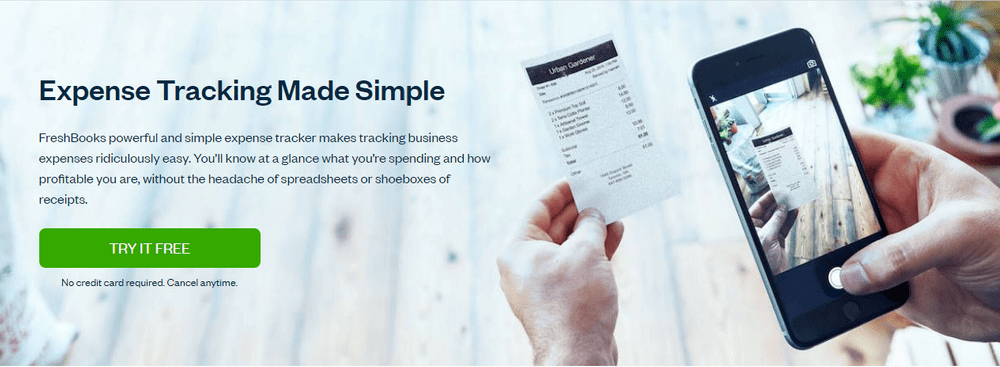

FreshBooks

FreshBooks is a business expense tracker app that helps track expenses for small and medium businesses. Your account will be updated every day by connecting your bank account and credit card.

It has the feature of taking the required data from the image you upload of any bill or receipt. You can also store your receipts inside Freshbooks. So, you have everything during the time of filing for taxes. While in a project, your team can figure out their spending, and also their expenses can be monitored by you.

It helps you track the amount of work done during the day from anywhere. You only need to focus on nurturing your business as everything is automated.

The pricing offered is minimal for different plans, but the app is helpful in the long run, irrespective of the pricing.

Mint

You can see your whole financial life through Mint. Mint offers you customized solutions, personalizing your experience of spending and expense tracking.

All your due bill payments and monthly expenses can be integrated into Mint along with other apps. It allows you not to miss any amount and track where you spend your money.

The app allows you to set your budget, ensuring that you adhere to it by sending timely notifications if overspent. It also gives recommendations on saving money and reaching your financial goals possibly faster.

The account opening process is safe and secure and is available on all devices.

Expensify

Expensify enables its users to keep a record of an unlimited amount of receipts. By syncing your accounts to Expensify, you will be left with very little work during this tax season. You may also set custom tax rates for a specified expense policy.

Manually uploading your expenses is outdated. Here, all your bills and receipts are automatically scanned just by a single click. Additionally, if you are bored with all these processes, you can further opt for an Expensify card instead of receipts.

You can try the free version, for it is easy to use and provides you the pathway to think in the right direction for your business expenses. It helps you track costs while moving, at home, or in your office.

Bench

The Bench app acts as your virtual bookkeeper. At Bench, software and the human brain are paired. The main focus is on small businesses and entrepreneurs preparing financial statements for their businesses.

A team of dedicated experts takes everything, and you are only contacted if something is needed. The bookkeeping is done monthly and makes you and your business tax-ready financially. The dedicated expert team is fast and reliable.

The app lets you focus solely on handling your business without worrying about tax regimes. It is one of the top in-use software. The prices are affordable, and a trial version is also provided at the beginning to understand the app better.

Shoeboxed

Shoeboxed is an app that provides its users with digitization services. It aims to digitize actual receipts reducing human errors. It also supports the integration of various apps to ease the workflow.

The app handles tax filings, storage of scanned receipts and bills, and provides expense reports. Keeping essential documents in the archive folder comes in handy when needed urgently.

Using this application, you can create an online list of your team and keep it updated. It is supported on both Android and iOS platforms. Its accurate mileage tracking feature is used when you are on a budget trip.

Dext

Dext is a business expense tracker app that wants you to go paperless and do minimal paperwork. It makes handling numbers and papers easier by going digital with your accounts.

Dext will draw out essential data and store it in its memory by uploading bills, receipts, or invoices. It has above 95% of accuracy while filing the paperwork and saving your time and effort. This leaves you with a significant amount of time to grow your business.

Upload your data from anywhere and from any device. It offers and mandates over 30 integrations to maintain your workflow. The app is so designed that it is effortless to understand. You can get your free trial now if your business is small or you are an aspiring upcoming business enthusiast.

Concur

Concur helps you grow as a business professional since the app constantly grows and adds new features. Here, by amending the settings according to your needs, you can make the app adapt to your ways.

You can calculate the ROI of your business with high accuracy. It has an accessible dashboard allowing you to see all your spending on a single page. You can make alterations to your budgets and control them anytime, anywhere.

You can also look at the demo of the app’s working, which is quite simple. Concur allows you to take financial decisions backed by solid data holistically. It proves to be of great help for small business owners and young startups.

Certify

Certify provides some great insights into expense management. This tool is effortless to create and handle reports and make reimbursements. You only have to upload a picture of your expenses, and the report is created automatically.

It is a perfect built-up for global business as it is available in over 60 languages and 140 currencies. You can integrate your business credit cards and policies with the app and personalize each thing according to your budget.

Here, integrations with a wide variety of apps are also supported so that your work does not stop. The app is supported on all devices and has seamless performance and high user satisfaction.

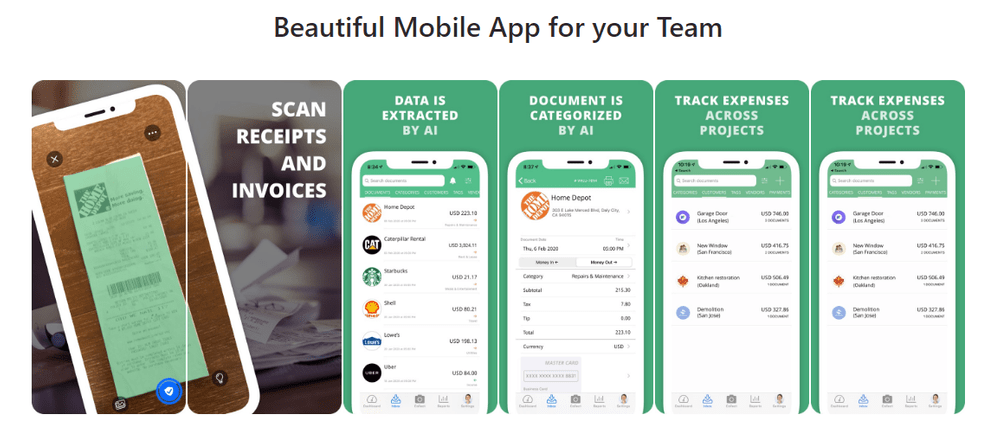

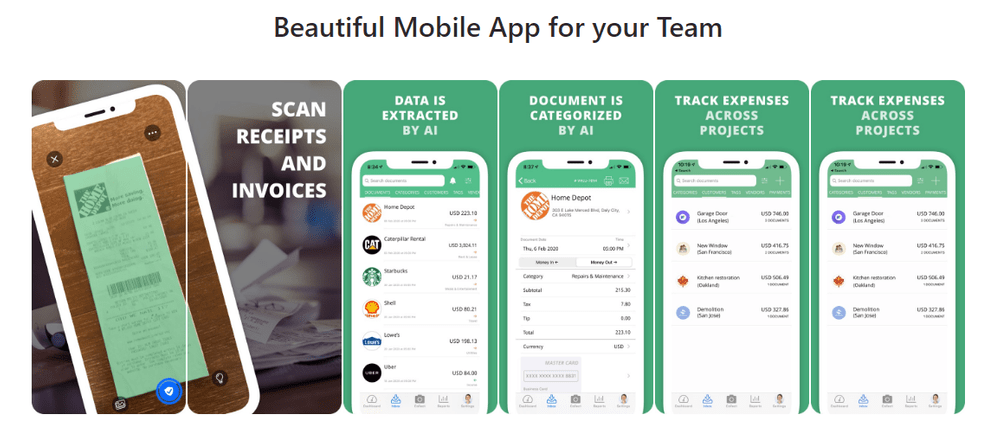

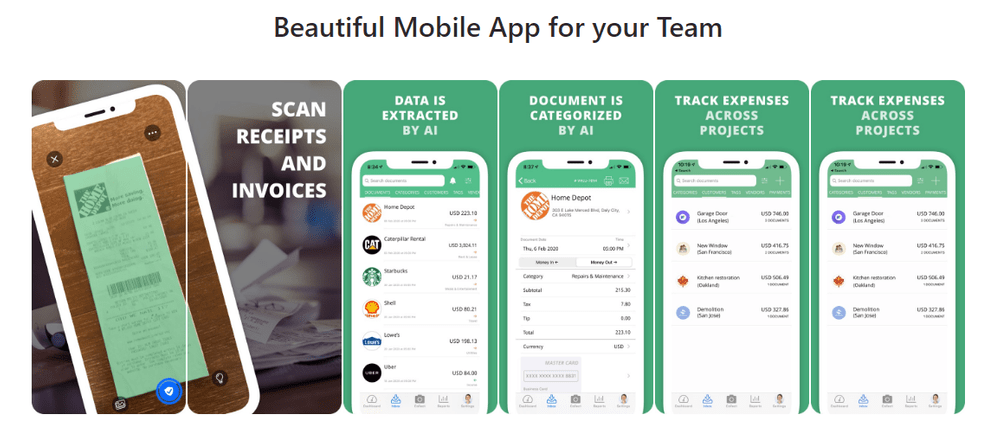

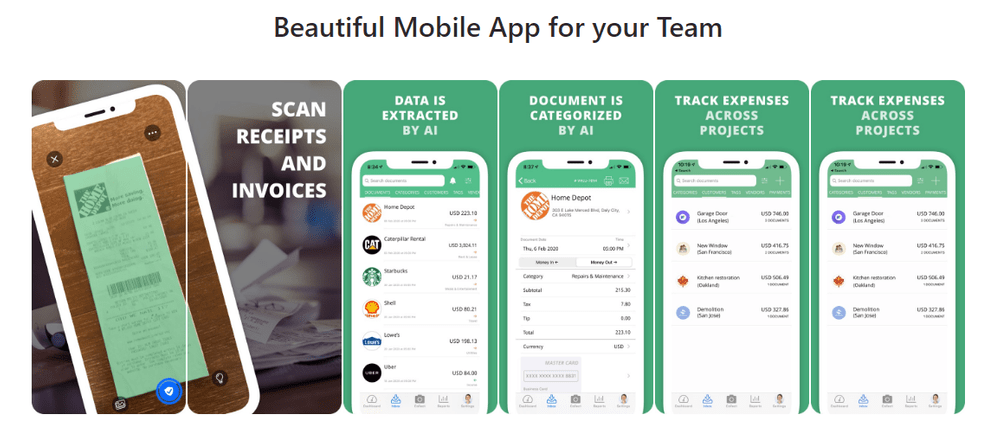

MMC Receipt

MMC Receipt is an expense tracking and receipt scanning app. The app quickly scans bills and receipts in various currencies with high data precision.

There is no limit on the uploading of receipts and the number of users. You need not worry about the storage space since the app has unlimited cloud storage and lets you store without restrictions.

Setting up of multi-stage approval feature gives your business a further boost. It assesses whether the captured data is ready to be exported or not, helping in enhancing your decision-making ability.

You can also look at the demo version to further understand the app’s features and try its free version.

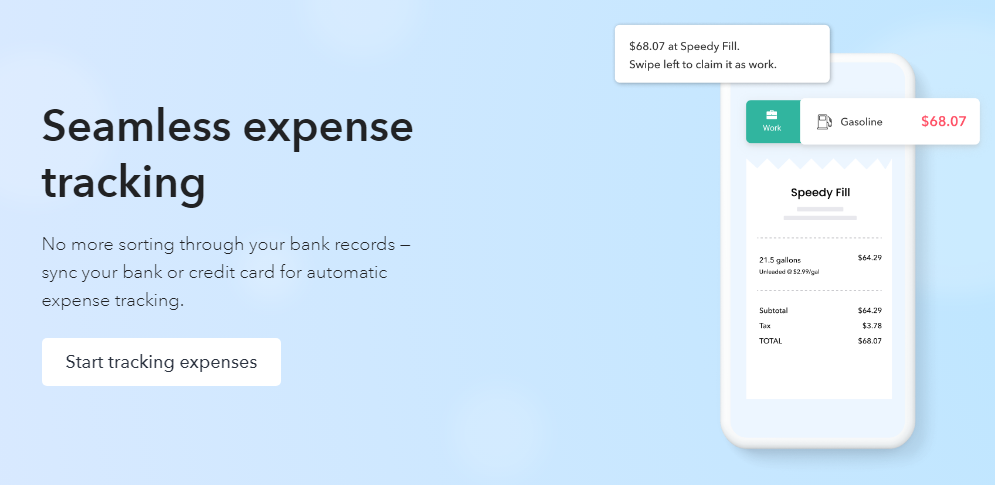

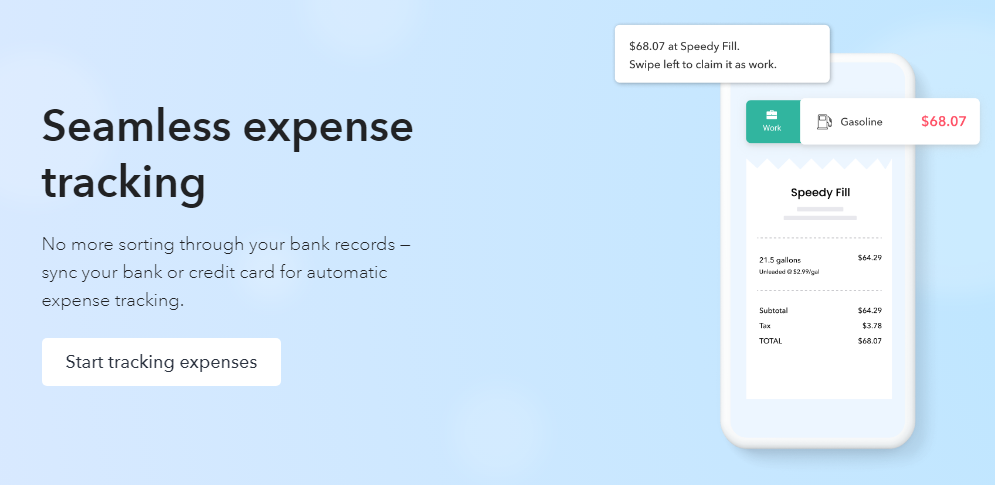

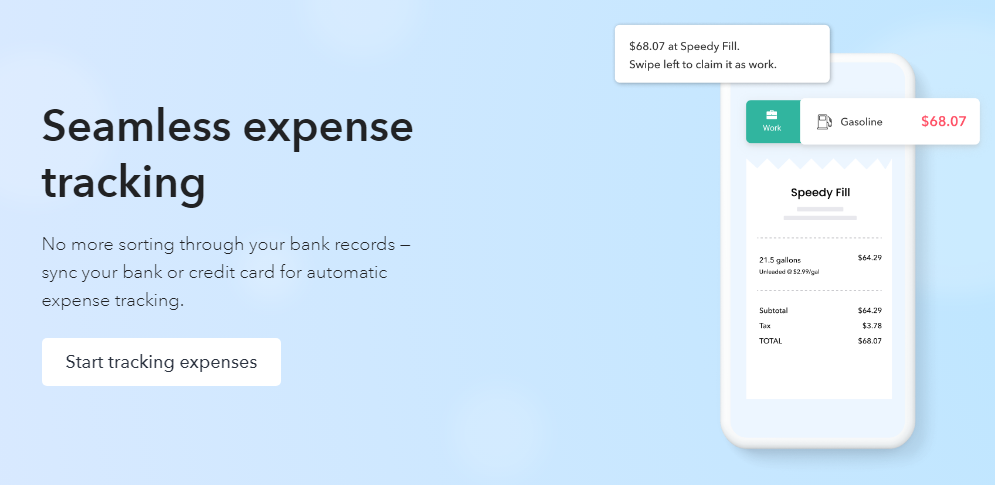

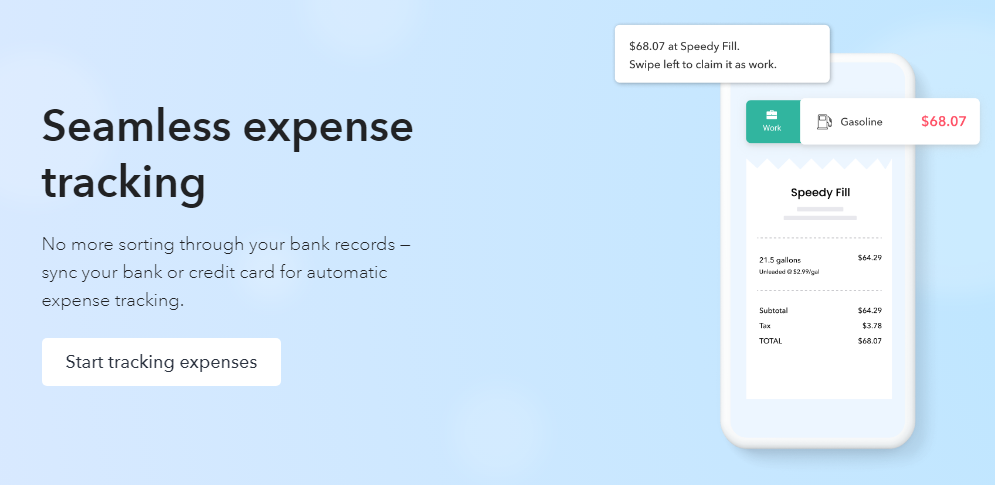

Everlance

Everlance has made handling business the main priority of business owners by automating the maximum number of things. With a single nick on the screen, you can sort and manage your expenses. Customize your personal and business spending on this platform and be burden-free during the tax season.

Data transfer is secured, and organizing cloud storage is easy. Connect multiple business cards at once to save your time and effort for managing expenses. Suggestions relating to tax deductions are its stand-out feature. You can save your taxes by providing timely and correct information.

The customer support team is at your disposal seven days a week for any queries. You can choose its free version to try where it provides many features. Other than that, you can even create your personalized template according to your needs.

Wave

Wave is more focused on nurturing small businesses to their full potential. It has hi-tech software that is simple to handle and secure to manage your expenses.

It also enables you to track your profit and loss in real-time and keeps you ready for the tax season. The software is free to use unlimited times without limitations and hidden fees.

The only thing you must have while accessing the app is an internet connection. It is supported on all devices and is relatively easy to use. Data switching from different apps and websites are accessible remotely.

Veryfi

Veryfi helps small businesses to grow faster than ever. The app serves a purpose to its customers and has untapped growth potential.

Here, you can estimate your project costs or business expenses before the start of the project. The data is entered automatically into the app, and no manual work needs to be done. You can view the monthly report anytime, anywhere since it is available 24/7.

It is available on all devices and across all platforms. You can sync your email with Veryfi for ease of fetching bills and receipts. It has a wide range of other applications, and the app is in use across various fields.

How to Choose an Effective Expense Tracking Software

Picking the best expenditure monitoring program is critical for effectively managing personal or corporate expenses. When choosing expense-tracking software, keep the following aspects in mind:

#1. Functionality and User-handiness

Examine the features of the program, such as spending classification, receipt scanning, budgeting, and reporting. Check that it meets your unique requirements. Choose a user-friendly interface that makes expenditure input and navigation easier. Complex software may discourage regular use.

#2. Compatibility and Automation

Ensure that the program works across several devices and platforms, such as desktop, mobile, and web, to enable seamless expenditure tracking at any time and from any location. Look for automation features such as bank account synchronization, which lowers human data entry while increasing accuracy.

#3. Management of Receipts

Choose software that enables simple receipt capture and storage, such as photo uploads. Contemplate software that can interact with your current tools, like as accounting software, payment systems, or collaboration applications, to streamline data flow.

#4. Security, Scalability, and ROI

To secure sensitive financial information, prioritize software with robust security features such as data encryption and multi-factor authentication. If you’re thinking about utilizing the software for business, be sure it can expand with your organization, supporting more users and data traffic. Evaluate pricing schemes and the value they provide. Free alternatives may have limits, whereas premium plans should be tailored to your budget and requirements.

#5. Analytics and Customization

Examine the reporting features to ensure that the program creates clear and insightful data that allow you to track expenditure trends and make educated decisions. To adapt to your specific financial position, a decent program should allow you to customize spending categories, labels, and budget targets.

#6. Potential Revisions

Investigate the software’s history of updates and enhancements. Regular updates suggest an active development team dedicated to improving the functioning of the product. If available, use free trials to evaluate the software’s features and appropriateness before making a purchase.

Note that the best cost-monitoring software should be tailored to your specific needs and preferences, allowing you to keep financial control, improve productivity, and make educated decisions. Read other users’ reviews to gain insight into their experiences. Consider software that has a good reputation for dependability and client satisfaction.

Before making a selection, do your homework and analyze several possibilities.

FAQs

Yes, many cost-monitoring software alternatives allow you to independently track personal and business spending. You may categorize spending by kind, create different budgets, and produce distinct documents for both personal and commercial activities. These software solutions often allow you to set distinctive groups and labels for both personal and commercial transactions, allowing you to precisely organize and track your funds.

Yes, many current cost-monitoring software choices allow you to create detailed expense policies and procedures to enforce spending restrictions inside your organization. These systems often provide options to set spending limits, approved categories, and approval processes.

Conclusion

Gone are the days of finding a good bookkeeper for your business for filing tax returns. All you need is a business expense tracker app and nothing else. However, choosing the right app for your business to grow and efficiently manage costs is equally essential. Using these apps in your business will leave you with an ample amount of time, effort, and energy for yourself and your family.

Here are some tools to help with resource management and Active Directory and Office 365 Management for your business.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones