NetSuite and QuickBooks are two excellent solutions that help businesses manage their accounting processes.

As an organization grows, its data keeps on increasing, and business operations like accounting, bookkeeping, business management, etc., become complex. Therefore, manual bookkeeping is not sufficient and effective to meet your needs.

This is why modern businesses are on the lookout for efficient business management solutions.

If you want to automate your bookkeeping processes, lower your operational costs, boost productivity, and automate key business processes, choose a reliable solution with useful functionalities and features and scale your business efficiently.

Although there are many accounting software available in the market, NetSuite and QuickBooks are hugely popular. They are similar in many ways but differ in their functionalities.

In this article, I’ll discuss and compare NetSuite and QuickBooks, their features, similarities, and differences to help you decide what to choose between them according to your requirements.

Let’s start!

What Is NetSuite?

NetSuite is an all-in-one business management software that has advanced capabilities like enterprise resource planning (ERP), customer relationship management (CRM), and e-commerce solutions. It is specially designed for high-growth companies. In addition, you get a real-time dashboard with KPI metrics that works well for mid-sized publicly-held companies.

NetSuite is owned by Oracle, which provides cloud-based ERP, CRM, e-commerce, professional services automation (PSA), and human capital management (HCM) solutions. This means you do not need multiple software programs for each of your business processes.

The platform deals with complex accounting jobs, such as GAAP revenue recognition for financial reporting. It can also efficiently handle each finance statement from global entities.

With NetSuite, you can perform tasks like forecasting sales, creating budgets, determining cash flow, and meeting financial needs faster.

In other words, it is a complete management system that lets your employees handle business processes, assess results, create dashboards and reports, etc., to enable better decision-making.

NetSuite allows your financial accounting team to close accounting books quickly, giving them more time to analyze and support decision-making and enhance company initiatives. It also helps increase business efficiency to reduce staffing needs and saves time and money.

NetSuite is suitable for businesses of all sizes:

- Large businesses get benefits like NetSuite OneWorld, which offers global multiple subsidiaries, multi-legal entities, and various currency capabilities.

- Midsize businesses can leverage NetSuite ERP software. This provides real-time transactions and reports, higher-level functionalities, analytical insights, and other features.

- Small businesses can utilize accounting software and make their operations more accurate and relevant.

NetSuite offers integrated human capital management software (HCM). Companies that plan for an IPO can use this software program to go public faster. It also works well for SaaS-based companies. The software offers visibility to the companies on upselling opportunities and customer feedback.

Main Features of NetSuite

NetSuite offers a variety of features, such as:

- Accounts payable and receivable: It helps control basic accounting, such as tracking receivables and payables, handling bank reconciliation, etc.

- Fixed asset management: It helps monitor the asset lifecycle and handle essential data. It also helps track lease agreement data.

- Invoicing and billing: This helps in automating the billing and collection process.

- Flexible general ledger: This makes accounting easier by automating various accounting processes and customizing them to meet unique needs.

- Multi-tax compliance: Get an end-to-end tax management solution that generates detailed reports, automates calculations, and helps analyze transactions.

Other features are budgeting and forecasting, inventory management, financial planning and analysis, revenue recognition, WIP and routing, work orders and assemblies, procurement, and more.

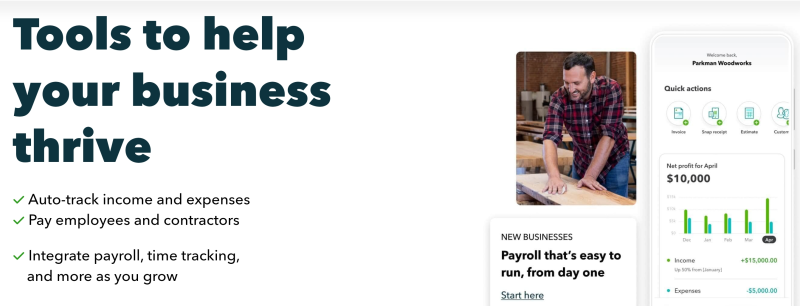

What Is QuickBooks?

QuickBooks is a low-cost business accounting system that’s ideal for small businesses and startups. It deals with basic bookkeeping and offers online payment services via Intuit.

QuickBooks accounting application handles accounts receivable, customer invoicing, accounts payable, general ledger, financial reporting, making or receiving payments, and more.

QuickBooks provides a set of solutions to manage inventory, payroll, sales, and other demands of a small or new business. Although it has evolved to offer support for different business operations, it has limited features and scalability.

Small businesses and freelancers can use this accounting software on the go since it is a cost-effective and user-friendly platform.

QuickBooks gives task management and a go-to accounting solution for your business. The two main highly useful solutions by QuickBooks are – QuickBooks Online and QuickBooks Enterprise.

QuickBooks Online is a cloud-based software platform that offers tools and solutions which are required to manage new or small business tasks, from bill payments and invoices to native reports and tracking cash flows. Some of its features are:

- Payroll management: It generates formats, paychecks, and accounting reports, processes payroll, clears taxes, and more.

- Income and sales management: It handles the income of the company, like invoices, sales, etc.

- Create financial reports: You will get basic financial reports, such as balance sheet reports, cash flow statements, A/R and A/P aging reports, etc.

- Cash management: It allows online invoice deposits and payments and can manage monthly financial statements.

- Automated tax payment: Tax filling is easy with QuickBooks Online, providing automatic tax payments.

- Bills management: It is easier to control cash flow, schedule future payments, remember due dates, pay online bills, and more.

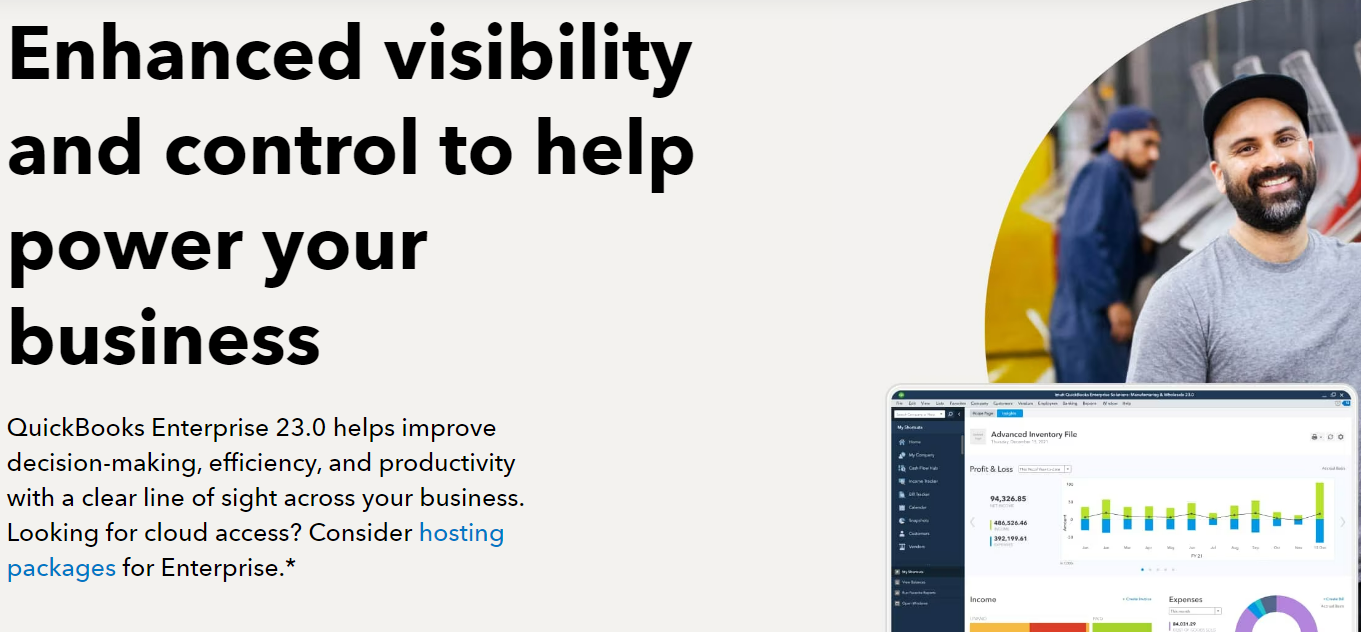

QuickBooks Enterprise is an excellent software solution that can help enhance the efficiency, productivity, and decision-making of your company. It provides everything you want in a single place, including accounting, reporting, job costing, inventory management, payroll, time tracking, pricing rules, and more.

Some of its features are:

- Enterprise accounting: You will get the capacity of over 1 million customers, inventory, and vendor items, 45 custom fields, and 100,000 classes. This helps you control your data by maintaining custom user permissions. It can streamline order management with a single dashboard that tracks your complete pick, pack, and ship process.

- Customizable and pre-built reporting: You will get 200+ customizable reports. You can even build your own reports or use 70+ industry-specific reports. In addition, you can create a budget, plan, and forecast scenarios. Easily manage your sales and inventory fulfillment, view expenses, and track job costs.

- Inventory across warehouses: Track inventory items easily and transfer them from one location to another according to your requirements.

- Manufacturing: Make your manufacturing process more scalable and efficient using automated inventory levels, purchase orders, and builds for all the assemblies.

NetSuite vs. QuickBooks: Similarities

NetSuite and QuickBooks are both cloud-based financial management platforms designed to help companies run their businesses.

Both offer similar functionalities with respect to financial management, such as accounts payable, accounts receivable, general ledger, multi-currency, and budgeting. Functionalities like order management, inventory management, and procurement are also similar in both platforms.

These platforms provide workflow automation features that allow you to automate your repetitive tasks based on accounting and streamline your financial workflows. This includes automating approval processes, generating automated notifications, and creating workflow rules.

NetSuite vs. QuickBooks: Differences

Both platforms are incredibly useful for business accounting. While both offer similar services, NetSuite is a far more comprehensive solution since it includes features like a CRM tool. Although NetSuite offers vast features and functionalities, QuickBooks offers a simple interface that is easy to learn by anyone.

Furthermore, while NetSuite is best for large enterprises, QuickBooks is a perfect solution for small businesses or startups to manage finances. Let’s discuss their differences with respect to their features and understand which one is suitable for which type of business.

| Features | NetSuite | QuickBooks |

| General ledger | It offers a more flexible and customizable general ledger. | It offers a more straightforward approach. |

| Cash management | Its cash management tools are comprehensive and offer real-time forecasting and visibility. | It offers an easy approach with simple-to-use bank reconciliation tools. |

| Accounts receivable | It offers greater customization and automation, allowing you to automate billing and manage collections. | QuickBooks offers an easy-to-use invoicing tool. |

| Accounts payable | It automates approval workflows, manages payment across various currencies, and more. | It uses easy-to-understand and easy-to-use bill payment tools. |

| Tax management | You can easily calculate taxes, manage tax schedules, and generate tax reports. | You will get tax calculation tools to calculate your taxes. |

| Close management | It automates the close procedures and generates period-end and close reports. | It offers period-end tools to get close reports. |

| Fixed assets management | NetSuite provides fixed assets management, letting you track the value of your business’s fixed assets. | QuickBooks doesn’t have this functionality. |

| Time tracking | You can automate time-based workflows. Also, you can track employee time across different projects. | QuickBooks has time-tracking capabilities that let you track employee hours, track time off, and process payroll. |

| Payroll | NetSuite doesn’t have built-in payroll capabilities. You can integrate with third-party tools to manage payroll. | QuickBooks has built-in payroll, allowing you to manage employee data, generate payroll reports, and process payroll. |

| Integrations | Connects with third-party software suppliers and all NetSuite ERP solutions | QuickBooks has more than 650 business applications. |

| Customer support | NetSuite offers 24/7 phone support. | QuickBooks offers support only during office hours. |

Use Cases of NetSuite

The use cases of NetSuite are numerous. NetSuite is versatile, as it can run your entire operations. Due to its wide-ranging functionalities and business intelligence insights, it helps you get immediate value and better efficiency. Therefore, it can be implemented in various areas.

Let’s discuss the use cases of NetSuite:

Finance

Finance companies deal with purchase and customer orders. Hence, it needs the financial management capabilities of an ERP system. With the help of this, all the accounts receivable and payable transactions are recorded and tracked automatically.

Therefore, company directors can have an immediate view into the company’s finances which allows them to have greater control over the expenditure and cash flow. The finance team of your company can generate important documents and reports quickly, like profit and loss statements and balance sheets.

Manufacturing

A manufacturer spends time researching and obtaining potential suppliers and quotes for raw materials, ingredients, and components. With the help of NetSuite, all these processes can be automated. Whether you want to request quotes or track your purchase orders, you can use NetSuite’s purchase modules.

The ERP manages suppliers’ lists so that the manufacturer can track the progress and make better decisions. Thus, the whole process becomes easier and time-saving.

Retail

NetSuite manages stocks so that a retailer can have confidence that stocks are accurate. A retailer can see stock levels in real-time and have a 360-degree insight into additional stocks. This will give a retailer an idea about when to order stocks and how much. It eliminates out-of-stock situations along with order fulfillment issues.

Use Cases of QuickBooks

QuickBooks offers a variety of solutions that can be used by any company, from small and large businesses to freelancers. Let’s see how you can use QuickBooks in your organization:

IT

With QuickBooks, you can generate customized and professional invoices quickly and deliver them effectively. Whether it is estimates, sales receipts, or invoices, with QuickBooks, you can have a seamless experience. It tracks expenditures and bills by linking your credit card and bank accounts. This helps categorize all of your finances.

Finance

QuickBooks provides a complete view of your sales, purchases, and projects. Accounting reports allow you to make financial decisions, optimize inventories, recognize trends, collect timely payments, and identify lucrative services.

QuickBooks can create custom reports based on the company’s needs. In addition, it helps you get an accurate statement of your profits and losses. This means you can efficiently run a balance sheet to evaluate and uncover patterns.

Retail

Retailers can pay online to their distributors immediately directly from their email, where they receive an invoice link using QuickBooks. Since you have QuickBooks, you can get all your sales, cash deposits, and credit card fees recorded in a single place.

FAQ

Yes, there are other alternatives to QuickBooks and NetSuite, including Sage Intacct, Microsoft Dynamic 365, Acumatica, SAP ERP, Xero, Certinia ERP Cloud, and so on.

A business uses accounting software to have easy invoicing and billing, tax calculations, and manage finances. The accounting software also helps manage clients, generate insightful reports on finances, and reconcile bank accounts.

There are many factors to consider while choosing accounting software, such as customer service reputation, stability, accessibility, features, security, cost, reports, and software type (cloud-based, etc.).

Accounting software is an incredibly valuable tool and plays an essential role in saving you hassle and time. When it comes to managing finances, having an accountant is beneficial to enable effective tax calculations. This will also help your business remain tax compliant.

Conclusion

NetSuite and QuickBooks are both bookkeeping and accounting software programs. Both can be useful play for your business but can differ in terms of features and usability for different types of businesses.

NetSuite is designed especially for large enterprises to handle finances along with other business operations. On the other hand, QuickBooks helps small businesses and freelancers manage their finances only. They each have their own set of pros and cons.

Thus, you can choose anyone between NetSuite and QuickBooks as per your company size and type and accounting requirements.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones