Stock screening platforms are gaining increasing popularity among traders and investors due to their ability to help you refine the list of potential stock trading opportunities from a vast array of stocks that align with your specified criteria.

Getting started with the stock screeners is easy if you’re aware of your fundamental and technical setup requirements. You also get the most popularly claimed pre-built scanners based on the basics of stock market parameters.

To get you started, here is a handy table of the ones we’ve covered that are definitely the best😉!

Title

Description

Explore

Yahoo Finance

Real-time stock quotes, charts, watch lists, stock screeners.

Finviz

Market visualization, stock screening by sector and indicators.

MarketWatch

Intraday stock screeners with various criteria options.

Investing.com

Real-time news, global markets, technical and fundamental screens.

TradingView

Charting, stock screening by fundamental and technical metrics.

Zacks

Research-driven stock screening with predefined and custom options.

StockRover

Instant loading screeners with over 140 ready-to-use filters.

Simply Wall

Visual financial metrics representation, customizable stock filters.

OTC Markets

Trading info for OTC securities, stock screener with filters.

Seeking Alpha

Investing community, premium stock screeners by criteria.

YCharts

Customizable stock screener, alerts, and in-depth analysis.

ChartMill

Technical and fundamental stock screening, chart analysis.

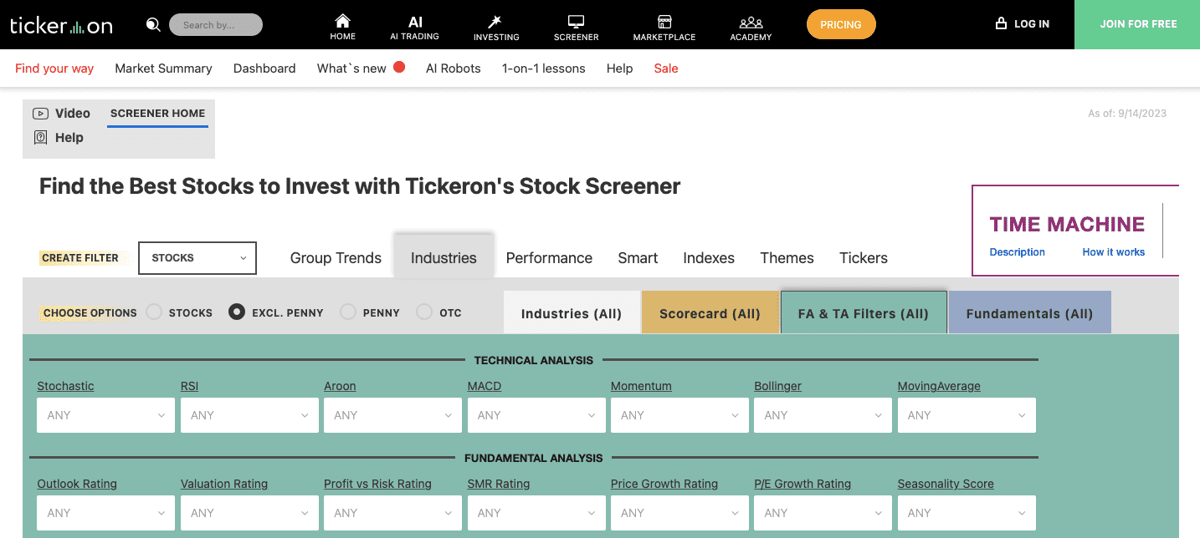

Tickeron

AI-based screeners for traders, technical and fundamental filters.

However technical it may sound, this article will help you understand the details of stock screeners and the screening platforms available in the market.

Let’s begin!

What is a Stock Screener?

Stock screeners are tools that help traders and investors filter out stocks based on certain parameters and criteria. Screeners simplify the process of finding opportunities from a long list of securities listed on the market.

As a part of their service, many brokers and financial institutions offer tools like screeners to ease any trading difficulties that their clients face while investing in stocks. These tools can range from a set of simple settings to advanced-level filter criteria, making it a good-to-go place for beginners and experienced traders.

Before we dig into the pros and cons of using stock screeners, it makes sense to understand how these stock screeners work and how a trader can best use screening platforms.

How does a Stock Screener work?

Understanding the workings of stock screeners is simple.

Once you log into a platform that provides a screener tool, you’ll find many predefined sets of criteria. These criteria are built using different filters for trading or investment purposes.

The filters used may be based on technical indicators like price action, volume, moving averages, crossovers, and chart patterns, as well as fundamental aspects like P/E ratio, stock ratios, dividend yield, and more.

After applying pre-defined or manual filters, stock screeners show the list of stocks or securities that meet your requirements. Traders and investors can use this list to spot trading opportunities.

Reasons for Choosing a Stock Screener

Here are some of the common reasons for using stock screeners:

Trading: Active traders, including intraday traders and swing traders, can use stock screeners to identify short-term opportunities and mint money based on technical parameters.

Sectoral analysis: Screeners help you identify the shift in sectoral trends and catch top-performing stocks in trending sectors.

Research: Long-term investors can use stock screeners to analyze the fundamental parameters that meet their investment goals. Investors can also use these indicators to identify new undervalued entries.

Save Time: If you’re a day trader, finding stocks that match your trading criteria daily is a time-intensive activity. Screeners, on the other hand, save a lot of time in finding such stocks.

Now that we have a good idea about stock screeners and their benefits, it’s time to explore some popular stock screeners used by traders.

Let’s begin.

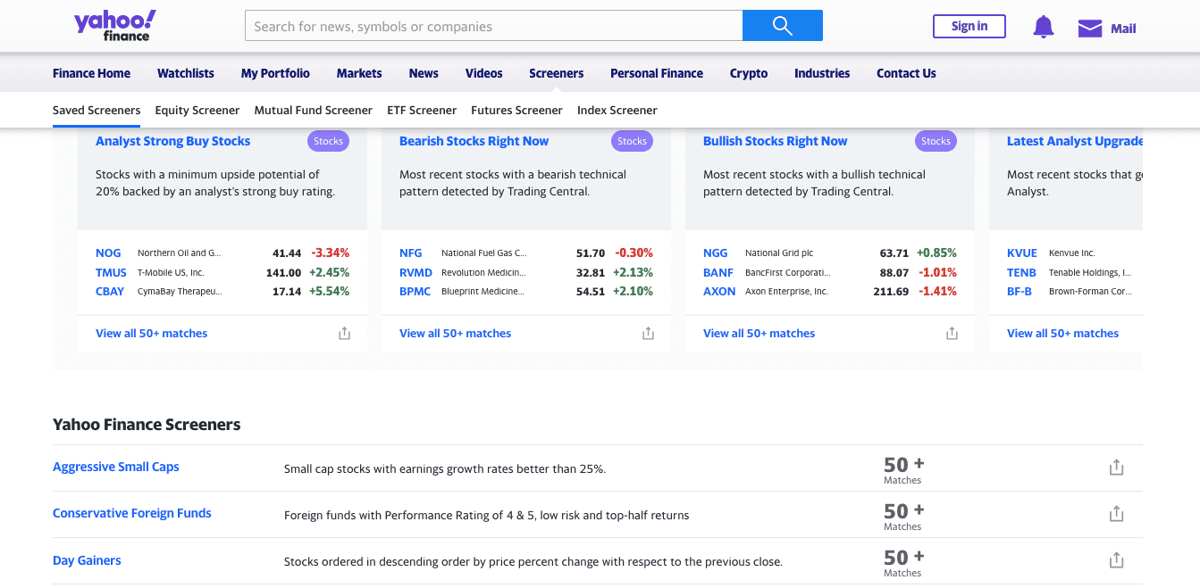

Yahoo Finance

Yahoo Finance is one of the oldest and most popular websites that covers financial news, stock quotes, financial reports, international market data, resources on portfolio management, and a lot of real-time finance content.

Yahoo Finance is a media property of the Yahoo network that aims to help investors build and maintain their wealth. Yahoo Finance’s YouTube channel has published over 43,000 videos and has a base of over a million subscribers.

The platform boasts various financial aid tools like real-time stock quotes, charts with technical indicators, stock watch lists, and various finance calculators. Like other tools, Yahoo Finance offers stock screeners, allowing users to filter stocks based on different financial ratios, market cap, industry, and more.

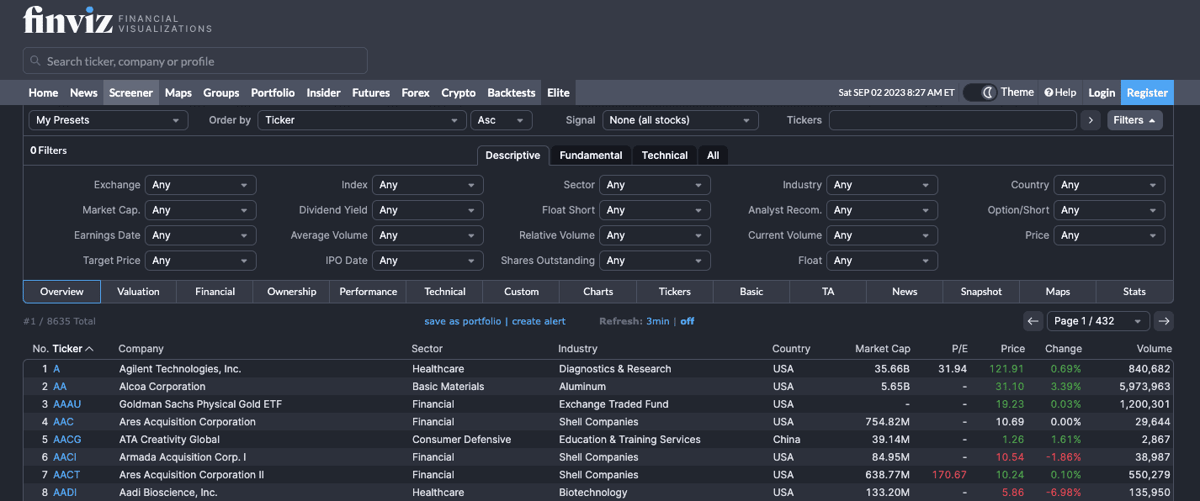

Finviz

Finviz.com is a popular financial visualization website with various finance tools for traders, investors, and finance analysts. The website offers a comprehensive view of market indices like Dow Jones, Nasdaq, and S&P 500 so users can see market movements at a glance.

The platform hosts plenty of powerful screeners, allowing you to filter stocks based on market criteria. For example, you can segment stocks based on their sector, fundamental performance, and technical indicators.

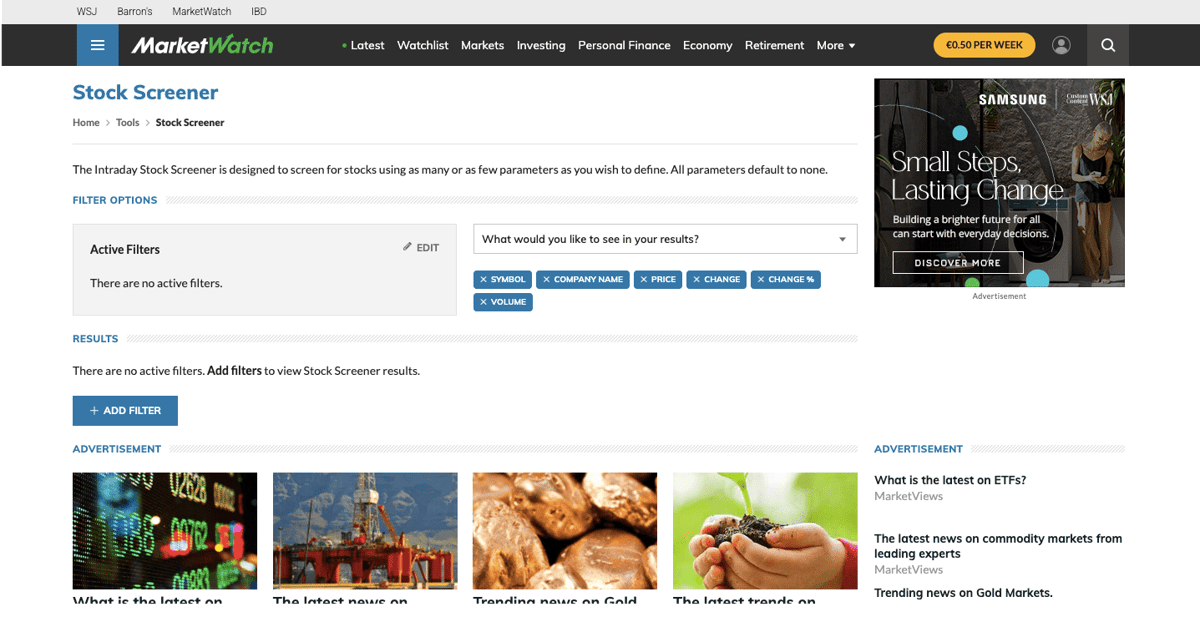

MarketWatch

Marketwatch has become a popular source for investors to make informed financial decisions and stay updated on the stock markets. The website covers all the major markets and also covers trending topics in its blog section to keep readers aware of the different market trends.

Marketwatch provides ready-made intraday stock screeners wherein you can add the filters like price range of a share, change in the stock price in %, volume, fundamental values for P/E ratio, market capitalization range, and much more. Once you set all the parameters, you get a list of stocks that match your criteria.

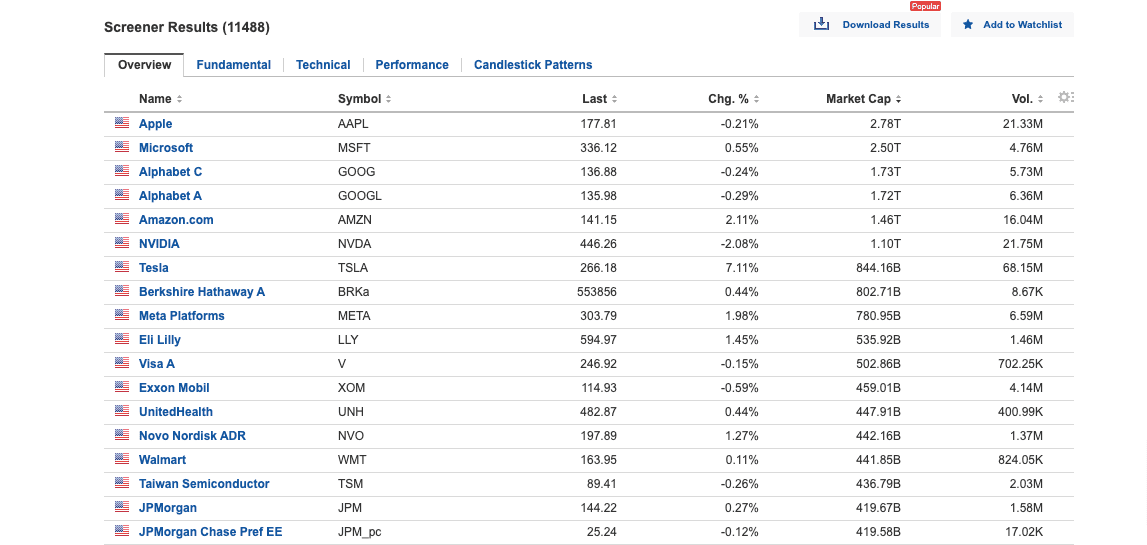

Investing.com

Investing.com is one of the top financial news and stock market learning websites. It includes everything related to markets, such as stocks, options, futures, commodities, and technical analysis. You get real-time news on global market happenings, price movements, chart streaming, and video tutorials for learning stock markets.

Being one of the widely used financial platforms, it provides a stock screening tool that supports almost all the major listed exchanges. Start by selecting the country and its exchanges like NYSE, and NASDAQ in the case of US markets.

Next, you can filter the sector type, industry, and type of equity. Now, you can start adding different criteria like fundamental ratios, price-based ratios, average volume, dividends, and advanced technical indicators.

Based on your filter criteria, you get the results as technical buy or sell calls on different time frames like 15 minutes, hourly, daily, weekly, and monthly.

One of the outstanding features of investing.com is that it also shows you the candlestick pattern for your filtered stocks, which can help you decide the trend in that particular share. You have the option to combine different technical indicators along with fundamental parameters to generate better and relatively safer stock opportunity picks.

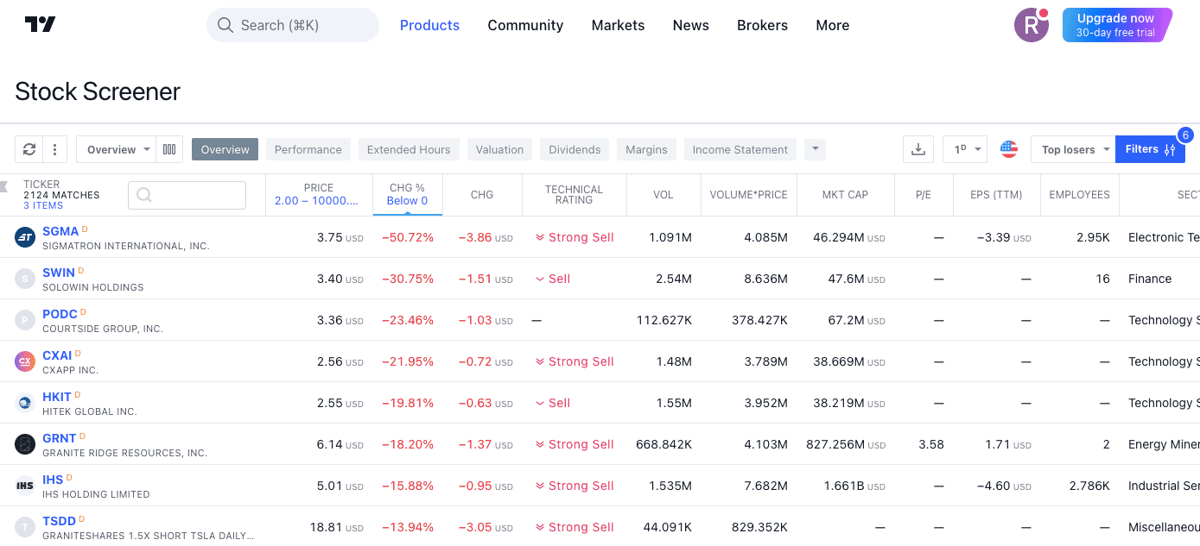

TradingView

TradingView is traders’ favorite charting platform and a social networking platform for the trading community. The free version gives you a simple and intuitive charting interface with limited trading indicators. And that’s also enough for most swing traders and long-term investors.

As a go-to platform for most traders, TradingView provides stock screeners for traders and investors to filter stocks based on specific metrics. For example, you can filter stocks based on their fundamental statistics, such as P/E ratio and ROCE, and technicals, such as moving averages, candlesticks, and chart patterns.

TradingView has many built-in screeners in the free version built by fellow traders, and you also have the option to create your screener by writing scripts. These scripts can be developed and made available for use by other traders on the platform. Besides, the platform has many stock screeners based on different types of candlestick patterns, indicators like crossovers, and chart patterns.

One of the biggest reasons for TradingView’s popularity is that it supports maximum markets, including Cryptocurrencies. It means whatever different markets you trade, TradingView is your go-to platform, even if you start with the free version. The stock screener dashboard offers options to sort, scan, and filter stocks based on pre-market and post-market hours. After market hours, you can download the reports in CSV formats for further data analysis.

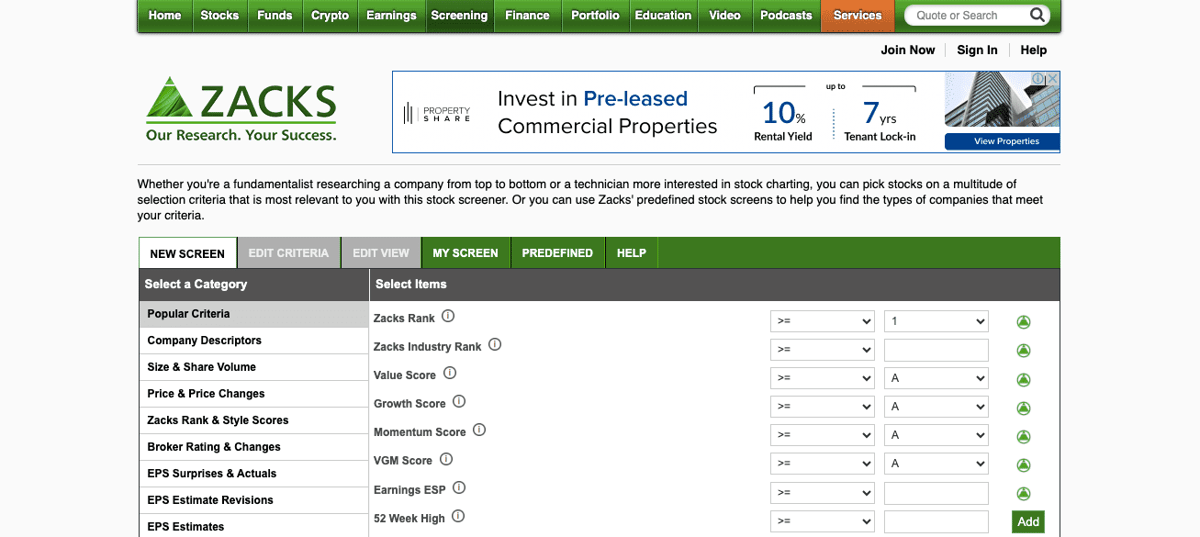

Zacks

Zacks is a research firm that helps investors find profitable opportunities. It’s a passionate research company that combines quantitative models with experienced equity analysts. The platform has many sections that touch on different areas of financial markets like crypto, earnings, stocks, and finance podcasts.

Zacks has a predefined screening section that helps you find different types of securities that match your filtered criteria. Once you’re on the screening menu, you’ll find screening tabs such as New Screen, Edit Criteria, Edit View, My Screen, Predefined, and Help.

You can start creating a new screen by editing the criteria on the New Screen tab, however, we recommend getting hands-on with existing predefined stock screeners.

Click on the Predefined Tab and select the Basic option. Here you’ll find pre-built basic screens such as:

- Classic Value with Growth: These stocks have attractive valuations with reasonable fundamental P/E ratios, and demonstrate positive historical earnings.

- Dividend & Earnings Growth: Stocks with high historical dividend yields are available in this screener.

- Sales Growth: Stocks with consistent sales growth of over 25% are filtered in this screener.

Additionally, there are bonus screens that include broker picks, low beta equities, screeners based on market cap, high P/E ratios, and many more. After you have a sound understanding of the platform and data representation, you can start creating your screen scanner to match advanced personalized screening criteria.

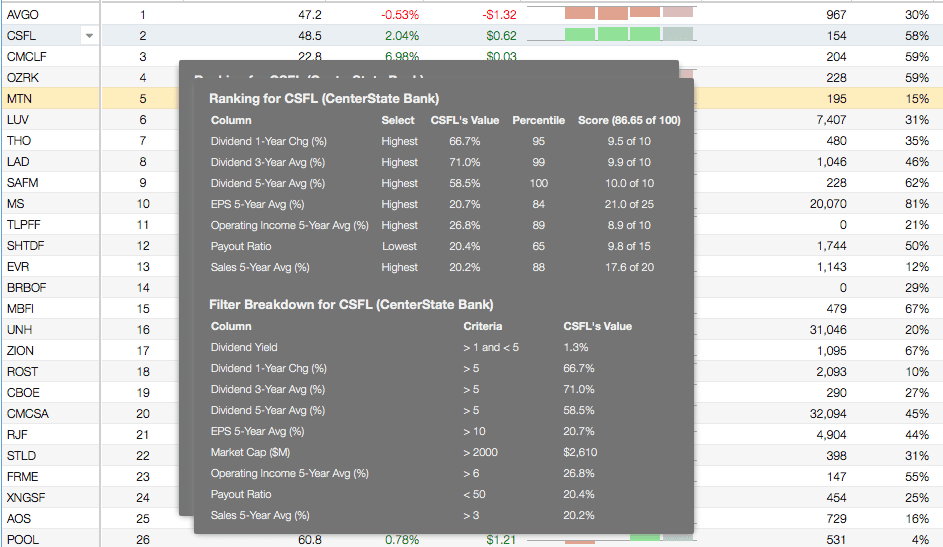

StockRover

StockRover is a financial news and investment research website just like Yahoo Finance. Besides the news section, the website provides a variety of finance-related analysis tools such as screeners, chart reports, comparison tools, research, and portfolio reports. Stock Rover is simple to use, and the website can be used on desktops, tablets, and mobiles.

Stock Rover offers a screening tool that helps you narrow down your stock picks as per your investment criteria filters. You can start by using pre-made screeners that show filtered results in just one click in a tabular format. The screeners on Stock Rover load almost instantly with updated data that gets refreshed every minute.

The platform has over 140 ready-to-use screeners that cover a variety of investment strategies. You can access all the screeners from their Stock Rover investor’s library. Besides, you can even create your screeners by modifying readymade screeners and creating new ones from scratch. Try creating a screener by combining filters from over 500 parameters that are distributed across technical, fundamental, and operational categories.

At a glance, Stock Rover is a good platform for screening stock picks for free. Just like stocks, you can use it to screen ETFs, mutual funds, and other investing instruments.

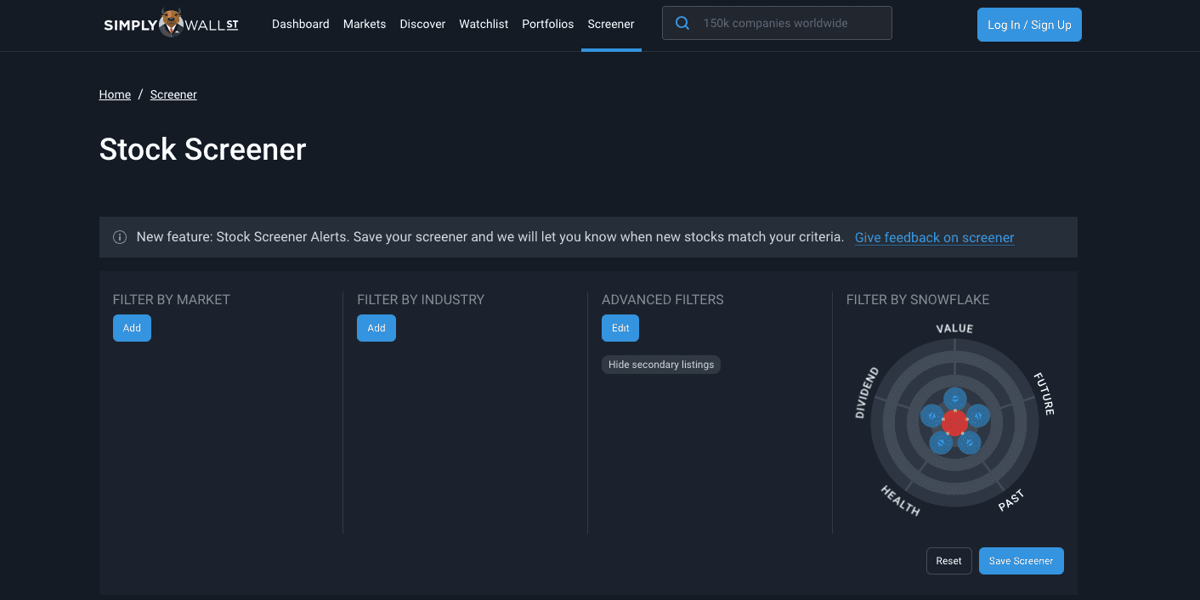

Simply Wall

Simply Wall Street is a finance company that aims to make long-term stock investments simpler for people. It helps investors and traders by representing financial metrics in a visually appealing and easy-to-understand format. For example, you can check summary points for a particular stock, understand valuation in graphical format, check part performance on ROE & ROCE meter, and understand financial health on bar charts.

The platform has a screener section where you can start adding stocks by choosing filters. Some of the starting point filters include filter by market, filter by industry, Snowflake filter, and other advanced filters. The filter by market supports most of the exchange markets, including US, UK exchanges, Germany, and other Asian markets. Next, select a filter by industry and selection criteria like P/E ratio, ROCE, and past performance from advanced filters, and you’ll get the results immediately.

Now, you can open individual stock items to get an overview of their valuation, past performance, dividends, financial health, management, and ownership. Simply Wall Street is free to use, however, you’ll have to create an account and log into their platform to access the information.

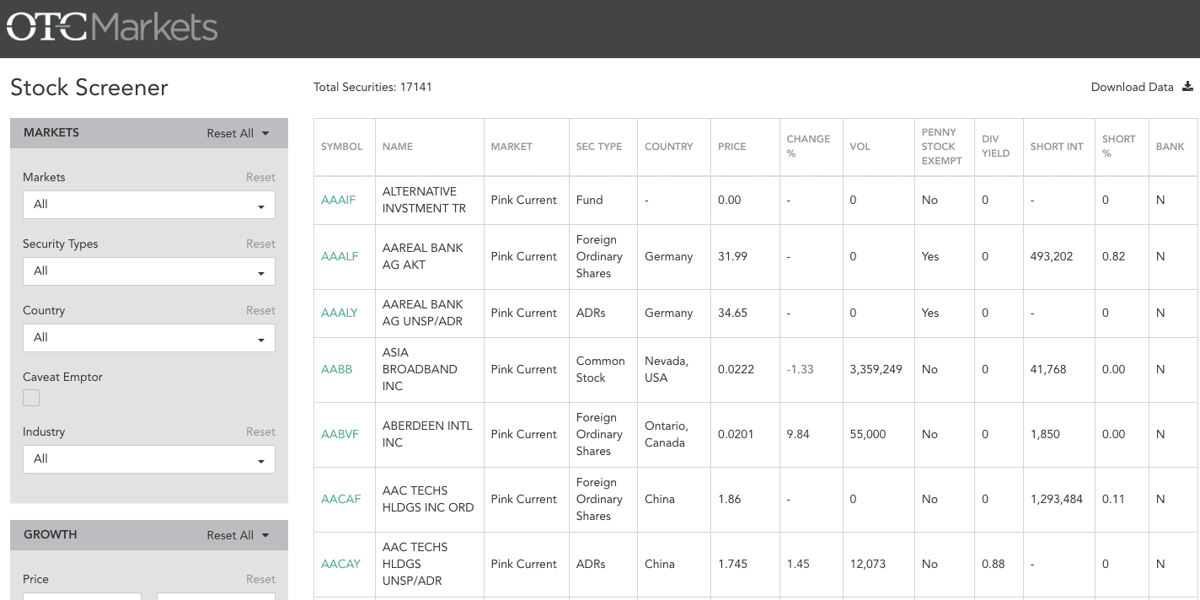

OTC Markets

OTC Markets is a finance website that offers information about trading stocks, bonds, foreign companies, and other essential screening tools to identify trading opportunities.

It’s a registered platform in the United States that offers over-the-counter (OTC) securities that support financial instruments that are not listed on the traditional stock markets, like the New York Stock Exchange or Nasdaq.

OTC Markets facilitates trading in stocks, mutual funds, bonds, and ETFs. OTC Markets have marketplaces like OTCQX, OTCQB, and Pink Markets that are under regulation by the US Securities and Exchange Commission.

When it comes to trading, OTC markets provide real-time trading information for OTC securities. It provides a stock screener wherein you get the filter to select the market type, type of security, country, and type of industry.

You can also filter the price performance based on the past week’s performance, dividend payer, and many more. Overall, OTC markets carry a higher risk as compared to listed securities because of less transparency.

Seeking Alpha

Seeking Alpha is an online investing community that publishes stock market news, investing ideas, and discussions around the merits & demerits of stocks for investors to make informed decisions. The platform covers all major investing areas like stocks, ETFs, commodities, cryptocurrencies, and mutual funds.

Seeking Alpha premium subscription unlocks stock screeners that you can use to buy strong stocks across different sectors, sizes, or themes. You can start using their pre-built screeners or even build your screener to find stocks that match your filter conditions. Some of the Seeking Alpha Screens are as follows:

- Stocks by Quant

- Top Rated Stocks

- High Dividend Yield Stocks

- Top Growth Stocks

- Top Sectoral Stocks

And many more.

Seeking Alpha offers different subscription services that include features like top stock screeners, strong buy picks, and real-time trading ideas. Their most subscribed products are Seeking Alpha Premium, Seeking Alpha Pro, Seeking Alpha investing Groups, and Alpha Picks plan. You can subscribe to their blog to stay updated on the market news, as the website boasts over 7,000+ investment-related articles.

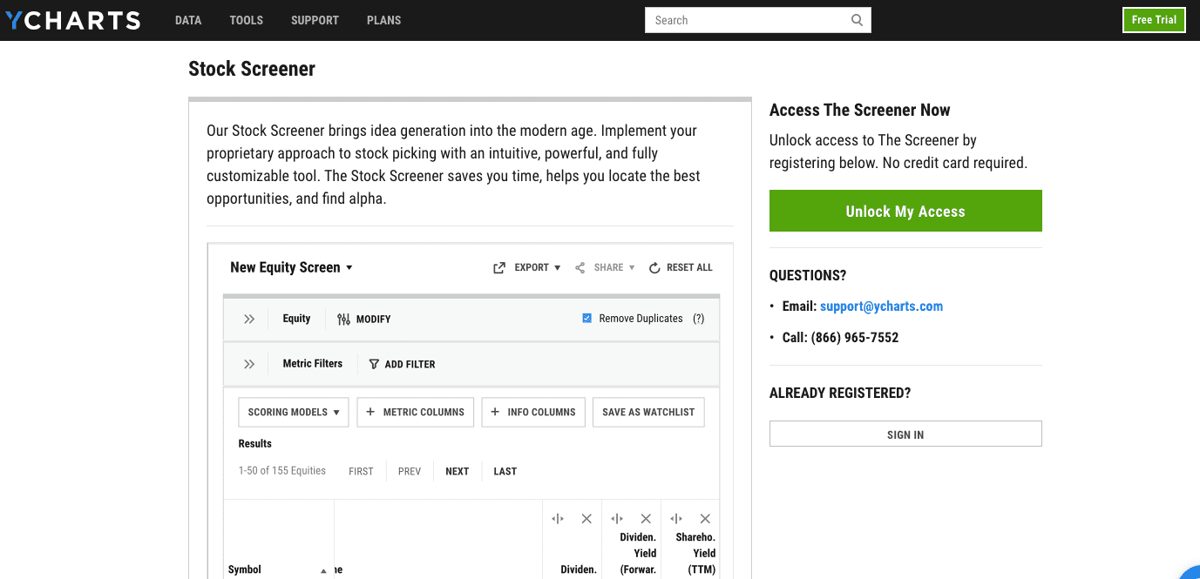

YCharts

YCharts is an all-in-one platform for researching investments and trending stocks. The platform provides intuitive tools that clients can use to stay ahead in their trading journey. Some of their prominent tools include Model Portfolios, Fundamental charts, Fund screeners, portfolio optimizers, custom reports, and technical charts.

YCharts also provides a customizable stock screener. It’s a modern stock-picking tool that helps you grab the best trading opportunities. The screener has a set of historical premium data that makes it powerful to maximize your profits and make sense while analyzing large data sets. You can use a variety of filters like PE ratios, revenue growth, and mathematical formulas on more than 20,000+ equities.

As an added benefit, you can save screens with in-depth analysis. It’s easy to run a screener once, and you can then set alerts whenever an equity meets or fails your investment criteria. You can easily save the results in watchlists and export data in Excel for further backtesting analysis.

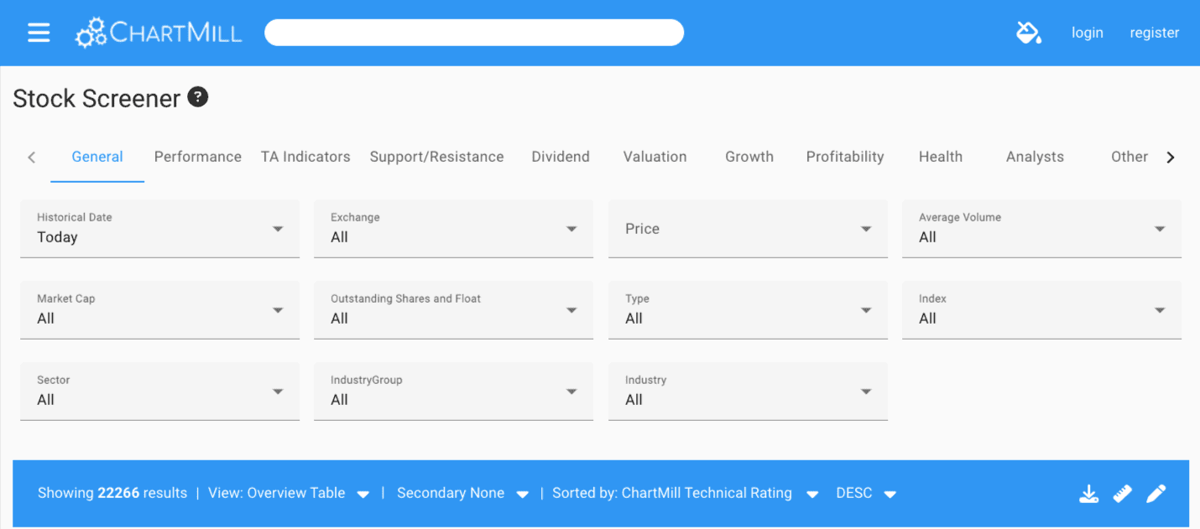

ChartMill

ChartMill is a chart screening and analysis platform that allows users to quickly filter out stocks based on technical structures, candlesticks, and chart patterns. The platform has fundamental information about stocks, however, the main focus is technical screening.

ChartMill’s stock screener allows you to search and filter stocks based on various search criteria, including technical and fundamental analyses. Most commonly used filters are available in the general section based on price, volume, market sector, and more.

Start by selecting the historical date, exchange, market cap, and average price. You can try using their different tabs like Performance, TA indicators, Support/Resistance, Valuation, and more to find the securities to match your trading criteria. You can use the platform to use its tools like charts and screeners for trading in the US and European markets.

Tickeron

Tickeron is a marketplace that has AI-based trading tools for traders and investors. The platform uses artificial intelligence and machine learning technologies to process big chunks of data at a minimal cost.

As an active market trader, you can identify your style as an intraday trader, swing trader, or investor and subscribe to Tickeron to use their platform. You can start using readymade screeners categorized according to their industry, fundamental ratios, scorecards, and technical analysis filters.

The platform hosts the most commonly used technical indicators such as RSI(Relative Strength Index), MACD, Bollinger bands, moving averages, and Stochastic indicators. Fundamental ratios include SMR rating, P/E ratio, Price Growth rating, valuations, and many more.

However, Tickeron is a paid platform, and you can use the different types of screeners after subscribing to their premium plans.

Summary

Trading is one of the most essential money-making skills that most of us wish to master. Using readymade stock screeners, you can narrow down profitable strategies and stay up to date on your trading strategies.

Over a period of time and after months of practice, you can create strategies that help you have an edge and make money as per your risk-reward ratio. After gaining experience, you can think of creating screeners that filter stocks according to your trading setup, and you can venture out into fresh markets like crypto, taking the benefit of crypto tracker apps.

If you’re interested in learning more about stock market trading and investments, don’t miss our in-depth article on deciding your position sizing for managing your trades.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones