Overview

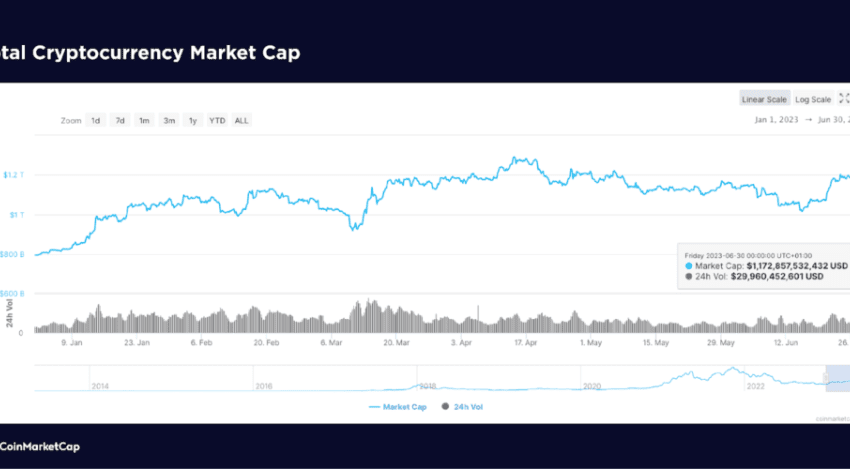

The global cryptocurrency market capitalization reached $1.17 trillion by the end of Q2, a 48% YoY increase. Q2 had a similar total market capitalization to Q1 but saw fewer new developments and projects.

In Q1, Bitcoin doubled in price, layer 2 projects like Arbitrum and ZkSync gained traction, and the NFT market flourished. Q2 was dominated by the “memecoin season” and BRC20 tokens.

The Crypto Fear and Greed Index started 2023 at around 30 (fear) but ended H1 at around 52 (neutral), indicating improved market sentiment.

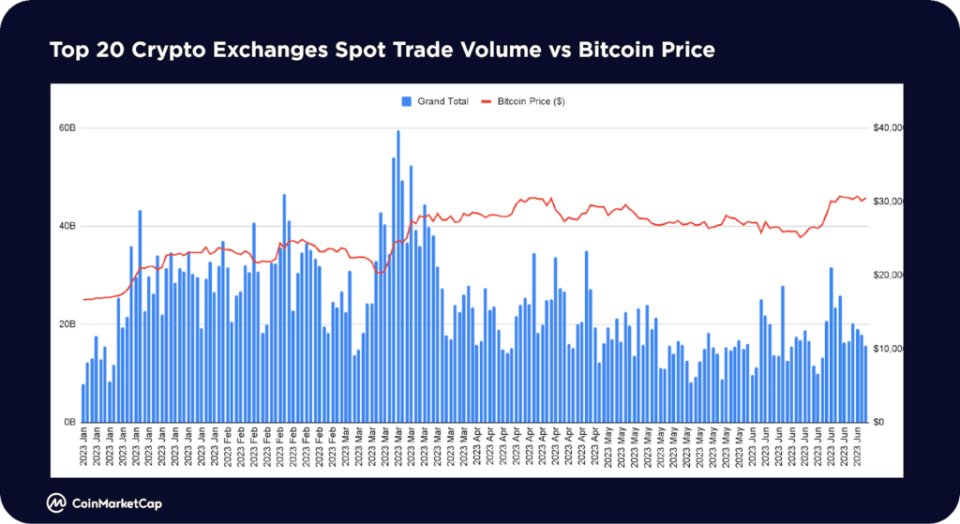

The top 20 cryptocurrency exchanges’ spot trading volume peaked in March and declined by 36% QoQ, reaching a low of $523 billion by June’s end.

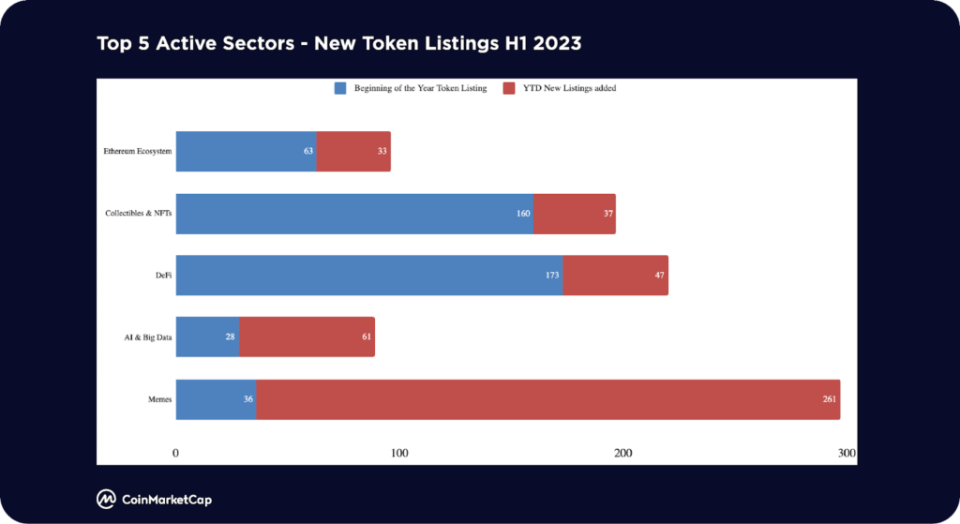

Despite challenging market conditions, certain sectors experienced significant market capitalization growth YTD. The Meme sector saw the most growth, with over 260 new coins added. AI and Big Data had 61 new tokens, followed by DeFi with 47 new tokens.

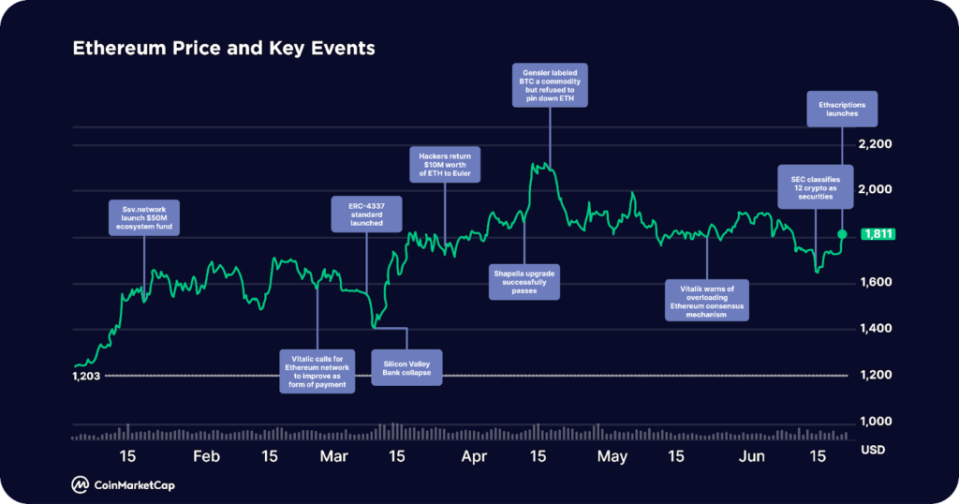

Now, let’s take a look at the notable events in Bitcoin and Ethereum from the beginning of the year:

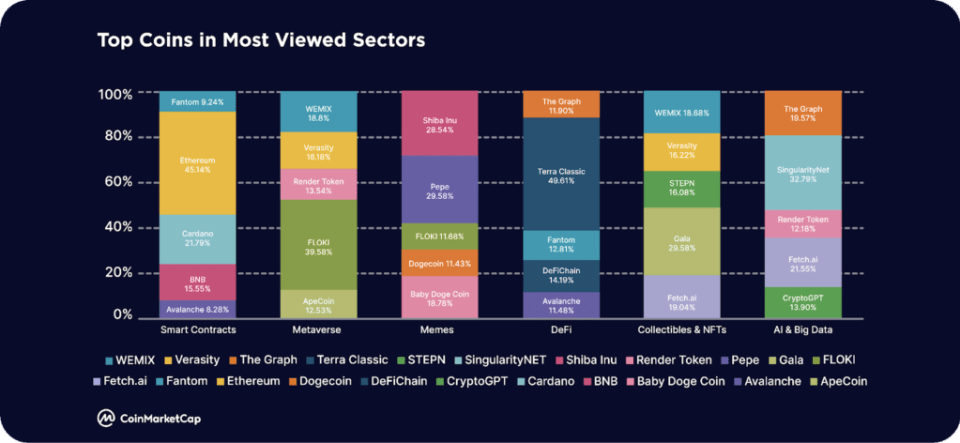

Most Popular Sectors and Coins

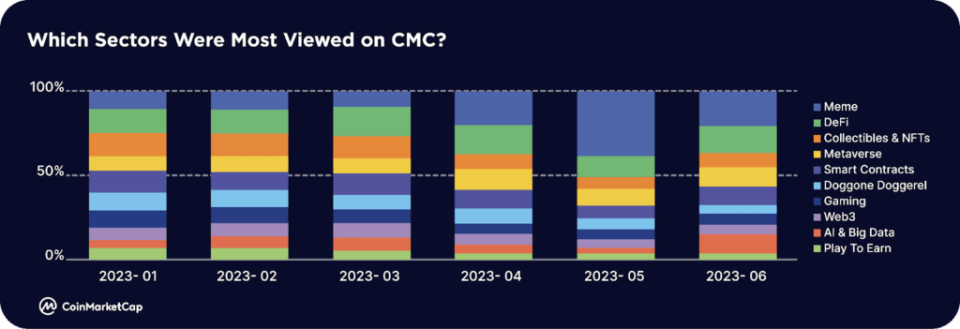

- Memes is a notable area with a significant increase in views in April and May, due to the speculative “memecoin season” led by PEPE.

- DeFi is the second most viewed sector, showing continued interest throughout the first half of 2023.

- NFT received significant interest in the first three months, mainly due to the release of Blur Season 1, but views dropped during the second half of H1.

- AI and Big Data are the most viewed fields in 2023, after OpenAI’s ChatGPT launch, AI-related issues have attracted huge attention in Q1 2023. June is a record month of strong interest in AI-related tokens.

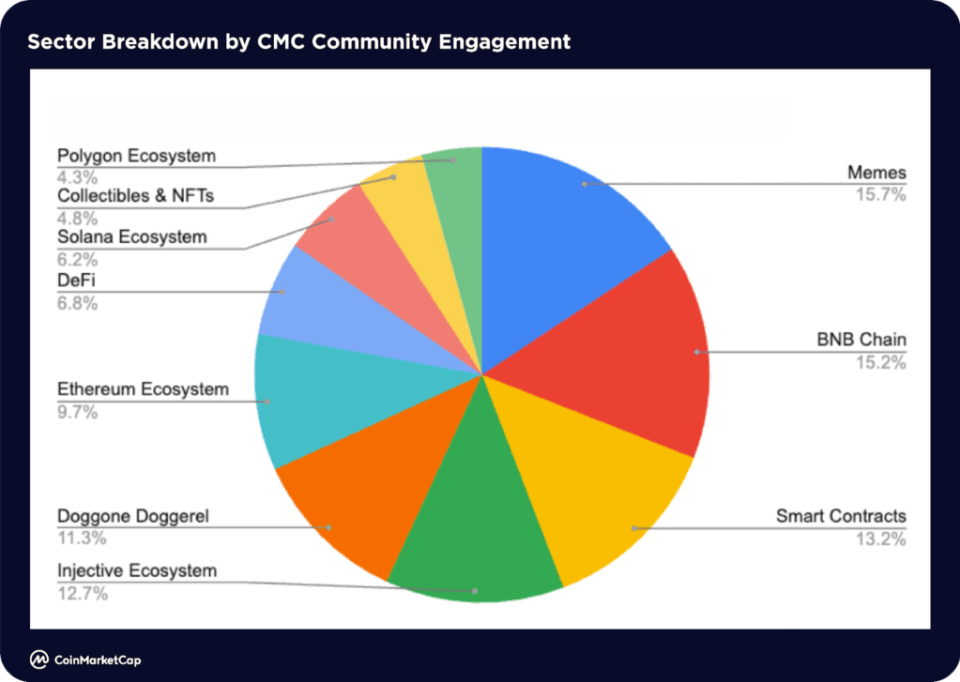

Most Engaged Communities

Memes have emerged as the most engaged community on CMC, with high levels of account likes, posts, comments, and views. The speculative season for memecoins in April and May witnessed an explosive “pump” for projects like PEPE, SNEK, and LADYS.

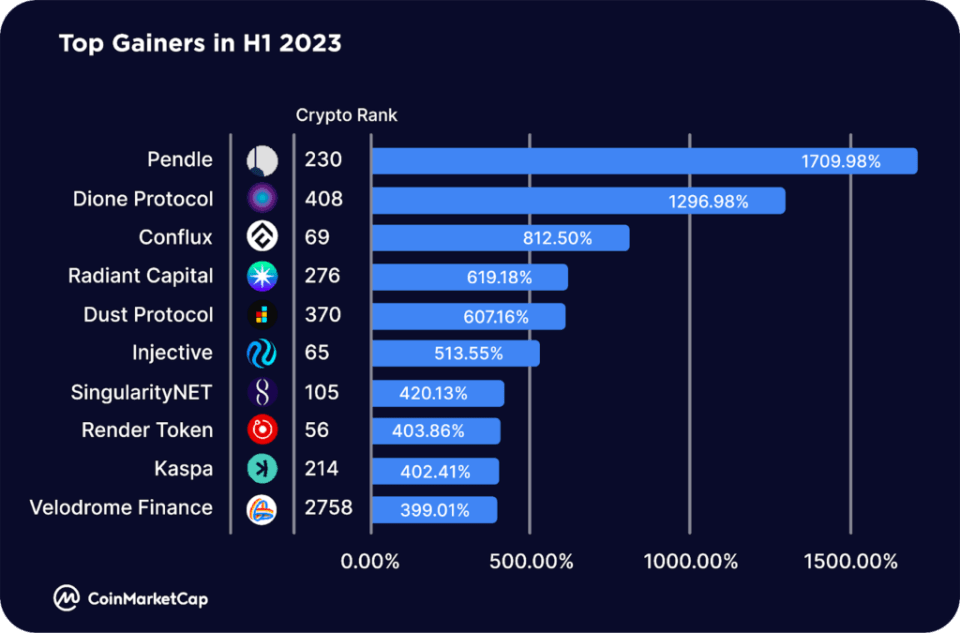

Regarding tokens, here are the top gainer during the first half of 2023:

H2 2023 Main Topics

ETF Bitcoin

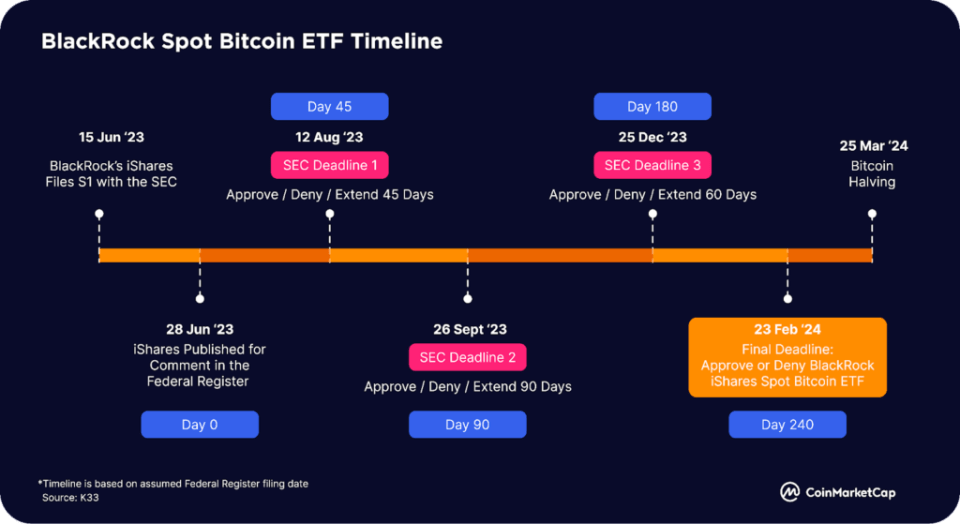

In June 2023, BlackRock filed for a Bitcoin spot ETF, increasing expectations for SEC approval in the US. Other industry players like Valkyrie, Fidelity, ARK Invest, and 21 Shares are also seeking SEC approval for similar Bitcoin ETFs.

Current global crypto ETFs and ETPs have raised $9.5 billion. Approval of Bitcoin spot ETFs in the US could trigger a surge in demand, potentially pushing BTC price well above all-time highs.

Decentralized Public Infrastructure Networks (DePIN)

DePIN offers solutions for sharing access to physical assets or services, incentivizing developers and users with tokens. Access is facilitated through staking, burning, or purchasing tokens/NFTs.

Real World Assets (RWA)

Today, projects aim to make RWAs tradable on-chain. This ecosystem includes credit market protocols like Maple Finance and Goldfinch for securing financing.

Other platforms focus on tokenizing various assets like real estate, collectibles, stocks, and intellectual property for seamless on-chain trading.

Liquid Staking Derivatives (LSD)

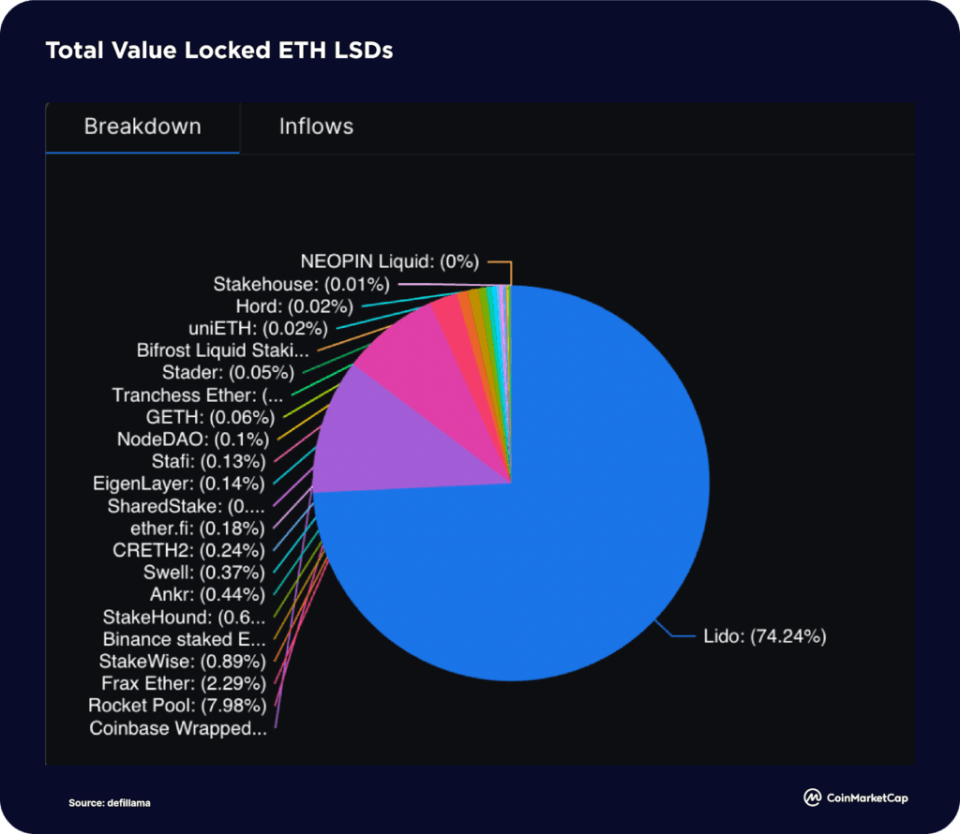

In H1 2023, LSD activity surged due to the Ethereum Shapella upgrade. Market leaders Lido and Rocket Pool saw their total value locked (TVL) increase significantly by 138% and 220% respectively.

H1 also witnessed substantial growth in LSDFi, with platforms such as Pendle, Lybra, and Flashstake reporting TVL gains. This growth is expected to continue throughout 2023.

Restaking

Restaking gained prominence in H1 2023 with the launch of EigenLayer, a middleware platform enabling the reuse of staked ETH or liquidity staked ETH tokens on the consensus layer.

This feature enables users to maximize their asset profits by staking them in other places.

ZkSync

In 2023, zkSync surfaced as a prominent layer 2 solution on Ethereum. It rivaled Ethereum’s Optimistic Rollup, including Arbitrum and Optimism.

As a zero-knowledge rollup (zkRollup) solution, zk-Sync leverages zero knowledge tech to offload traffic from Ethereum to layer 2. This improves Ethereum’s throughput and facilitates a plethora of novel applications.

Modular Blockchain (Celestia)

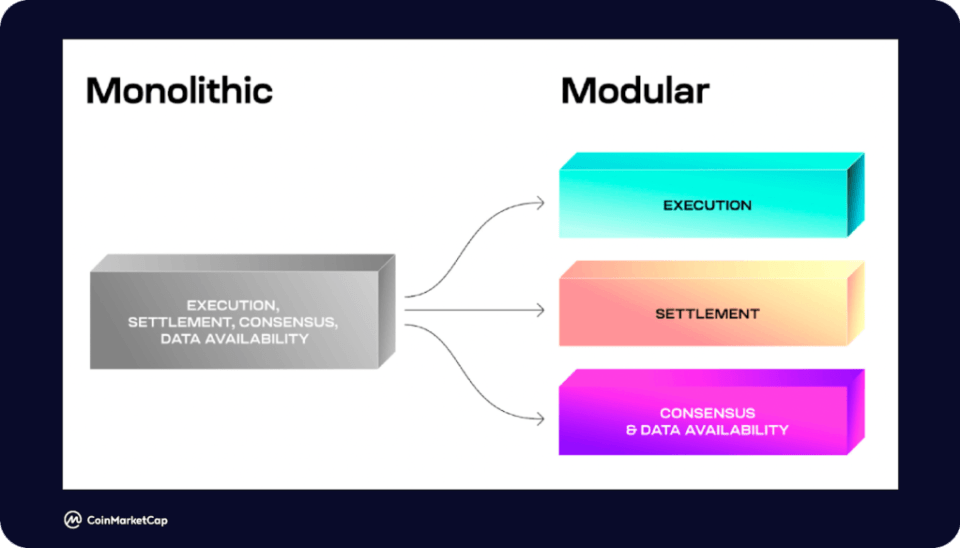

Modular blockchains like Celestia separate blockchains into enforcement, settlement, consensus, and data availability layers.

Celestia provides modular data availability and consensus layers for developers to use in dApps and sidechains.

Other platforms like Rollkit and Fuel offer modular payment and execution environments. These platforms can improve existing monolithic blockchains like Ethereum and Solana.

FTX Bankruptcy Developments

FTX depositors were left uncertain after FTX’s collapse last year, with a $9 billion shortfall in the settlement process.

However, it was revealed in January that over $5 billion in liquid assets were protected, and this amount grew to over $7.3 billion by April 2023.

Asset liquidation and compensation processes for FTX clients are now progressing, with a “customer bar date” of September 29, 2023.

FTX’s legal team is considering restarting the crypto exchange, but it is unclear if this will involve using debtor’s assets or attracting new funds.

Despite these developments, FTX debtors should not expect to receive payments until at least the second half of 2024.

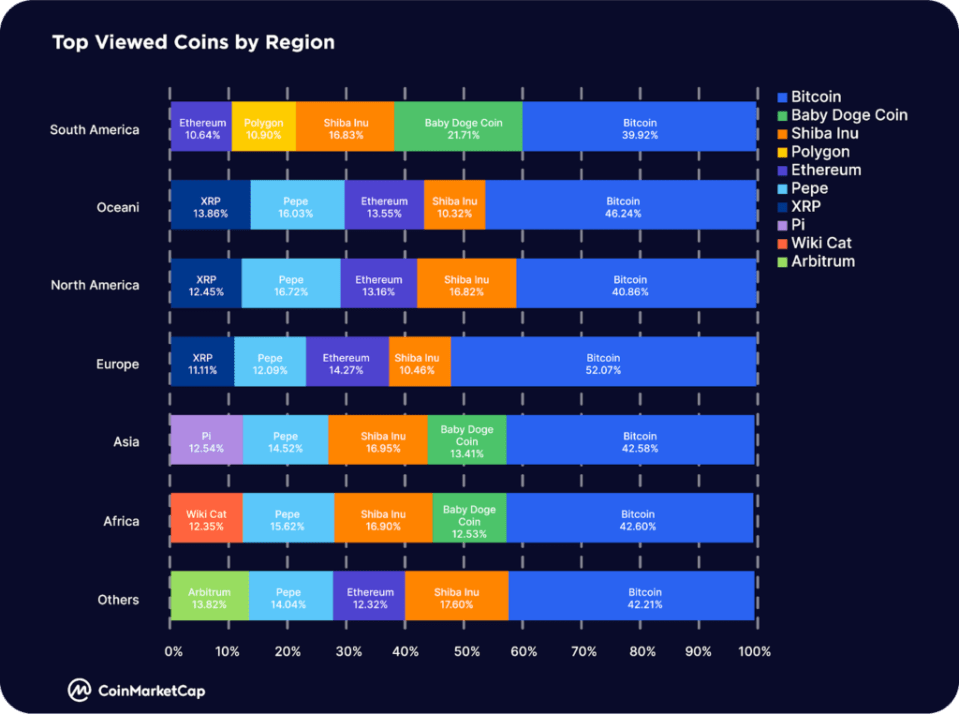

Top Viewed Coin by Region

In H1 2023, regional differences in interest in various cryptocurrency niches and sectors were not significant:

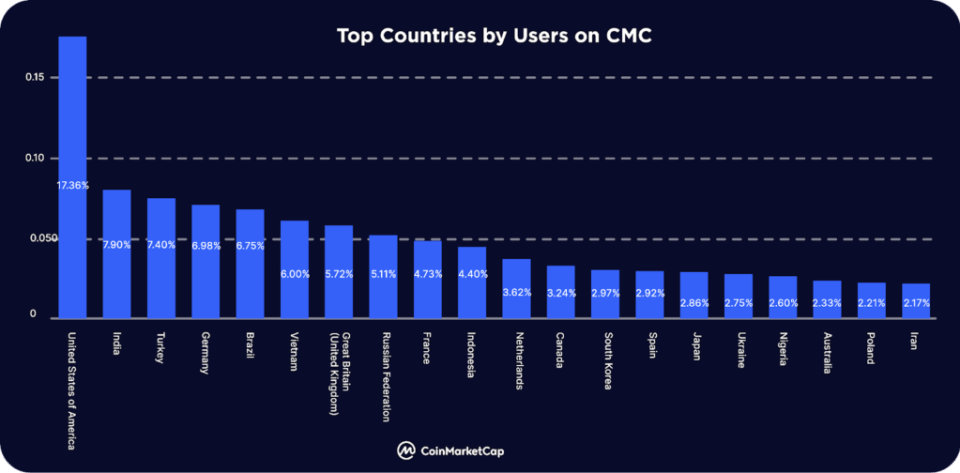

Top Countries by Users on CMC

The U.S. continues to dominate in terms of the distribution of cryptocurrency users worldwide. The vast majority of the remaining traffic is mainly among users in Europe and Asia:

(Reference: CoinMarketCap)

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones