Despite a difficult micro and macroeconomic scenario, blockchain gaming activity has stabilized as per the DappRadar x BGA Games blockchain gaming report Q1 2022. Security incidents, such as the recent half-billion-dollar hack of the Ronin Bridge, remind us that interoperability has costs. At the same time, the conflict in Ukraine and the poor performance of the cryptocurrency market hampered games’ further expansion last year. Still, compared to the previous year, blockchain gaming activity has increased by 2,000%.

The metaverse continues to flash one of the most intriguing potentials in the blockchain industry, as Game Dapps continue to flourish. VCs and other investors continue to pour money into blockchain gaming and metaverse ventures, with a total investment of $2.5 billion. Meanwhile, financial organizations estimate that the decentralized metaverse’s economic potential will reach at least $8 trillion.

Key Takeaways from DappRadar x BGA Games blockchain gaming report Q1 2022

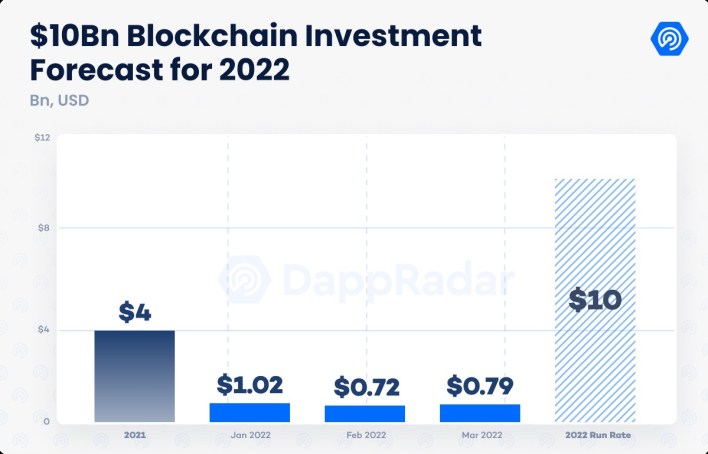

- Investments keep pouring into blockchain games as $2.5 billion were raised in Q1; at this pace, 2022 investments will be 150% higher than last year.

- Blockchain games attracted 1.22 million UAW in March, accounting for 52% of the industry’s activity; while the short-term usage seems steady, the use of blockchain games has increased 2,000% from Q1 2021.

- Sky Mavis undergoes a challenging period after suffering one of the most significant attacks in crypto history; still, Axie Infinity attracted 22,000 daily UAW in March, while Binance led a $150 million fund to recover assets from the Ronin bridge hack

- The metaverse continues to evolve; The Sandbox Alpha season 2, Decentraland’s Fashion Week, and NFT World’s value appraisal showcase the potential of the space.

- Splinterlands, Alien Worlds, and Crazy Defense Heroes drive blockchain gaming activity with an average of over 650,000 daily UAW in March.

52% of blockchain activity comes from game apps

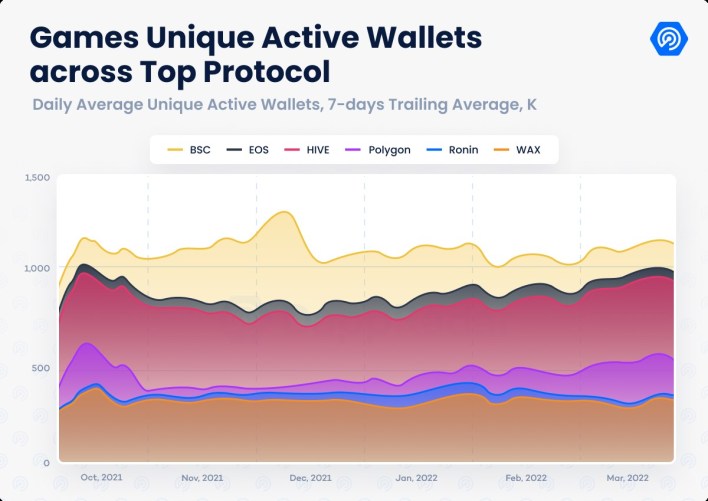

Despite the difficult circumstances, blockchain games maintained a consistent level of usage. During Q1 2022, a total of 1.17 million Unique Active Wallets (UAW) connected to blockchain games on a daily basis, down 2% from the Q4 daily average. The March daily average, on the other hand, topped 1.22 million daily UAW, indicating that the situation is improving.

Matic continues to gain traction as a blockchain activity challenger to the leading gaming ecosystems of Wax, Harmony, and BNB Chain. During the first quarter, game dapps on the Ethereum sidechain drew an average of 114,000 daily UAW, with a remarkable 173,000 in March. Crazy Defense Heroes, Pegaxy, Arc8, and Aavegotchi are among the play-to-earn titles that have boosted Polygon’s gaming activity by 219% since December 2021.

On the other side, since the end of last year, Ronin’s and BNB Chain’s on-chain activity has reduced. With the exception of Mobox and Bomb Crypto, the adoption of most game dapps on the Binance branded network has been largely volatile. Despite this, BNB Chain is the third-largest blockchain gaming network, with 165,000 daily UAW in Q1, down 33% from December.

Q1 2022 has been a challenging period for Sky Mavis

Meanwhile, amongst all this, Ronin is experiencing one of its most challenging periods since its launch almost one year ago.

The Sky Mavis team revealed on March 29th that 175,000 ETH and 25.5 million USDC had been taken after the Ronin bridge had been hacked about a week before. The hacker gained control of five of the eight multisig wallets required to approve deposits and withdrawals from the bridge’s custodian contracts, resulting in the theft of the second-largest sum of cryptocurrency in history.

While the hack forced Ronin’s native dapps to shut down, the drop in Axie‘s blockchain activity was not entirely due to the current attack; in fact, it has been declining for some time. The game’s on-chain activity peaked in January, when it averaged over 55,000 UAW per day, and has since dropped to just over 22,000 UAW per day in March.

Due to modifications made by Sky Mavis in the SLP rewards ratio to make Axie’s in-game money sustainable in the long run, the number of UAW began to decline in mid-February. Despite this, Axie Infinity is one of the top ten most popular games based on a daily usage, with over 1.5 million Daily Active Users according to off-chain data.

The Sky Mavis crew has suffered a significant setback as a result of the Ronin bridge heist. Despite this, the path to recovery has already begun. Binance and Animoca Brands, a16z, led a $150 million financing round to repay user cash affected by the incident. In addition, Axie has started a $1 million bug bounty programme in order to enhance the foundation of its infrastructure.

Axie Infinity is projected to remain a popular play-to-earn option for some months. It’s easy to forget that Axie NFTs was the first collection to surpass $4 billion in historical trading volume, excluding artificial trading, during this difficult period (LooksRare). Furthermore, according to Sky Mavis, the debut of Origin’s Beta was successful in April, garnering over 220,000 testers. Lucia, Axie’s virtual realm, is one step closer thanks to Origin.

In Q1 2022, the amount of money spent on blockchain games surpassed the $4 billion raised in 2021. VCs and investors have poured at least $2.5 billion on blockchain games and their underlying infrastructure in the first three months of 2022. Play-to-earn and metaverse-related ventures will add $10 billion this year at this rate, ensuring the industry’s survival.

Animoca Brands raised a $360 million investment at a $5 billion valuation, fostering its presence as one of the leading Web3 brands. Last month, Sequoia Capital led a $450 million investment in Polygon, a network nurturing one of the most enticing blockchain game ecosystems.

In March, over $785 million was invested across different projects. Yuga Labs, the studio behind the renowned NFT collection Bored Ape Yacht Club (BAYC), received a $450 million investment led by Animoca Brands, with The Sandbox, FTX, and Coinbase involved in the deal.

The investment further cements the status of Yuga Labs as one of the names to follow in the Web3 narrative. It also boosts the team’s metaverse plans as they prepare for the launch of Otherside. Otherside will become an interoperable metaverse platform involving play-to-earn games, fashion, and media.

It’s also worth mentioning Temasek’s $200 million investment in Immutable-X. (IMX). With the funding, the Sidney-based Ethereum scaling solution now has a Series C valuation of $2.5 billion. Gods Unchained and Guilds of Guardians are two prominent blockchain games hosted by IMX.

In the following months, Illuvium and Ember Sword will join these dapps. The funds obtained will allow the company to continue developing and scaling the IMX product.

After the excitement cycle sparked by Meta’s rebranding announcement in Q4 2021, interest in the metaverse has waned. In Q1 2022, the trading volume in virtual worlds declined by 12% from Q4 2021, hitting around $430 million.

The average price of land in Decentraland and The Sandbox has dropped by 40%, while trading volume has dropped by 20% and 60% on both platforms, respectively. Still, a broad view of metaverse platforms points to a positive future for this type of initiative.

The Sandbox completed its second Alpha season, attracting over 325,000 visitors to the 35 experiences opened for early players. Season 2 distributed around $30 million in SAND tokens. Plus, brands like Warner Bros, Ubisoft, and HSBC have closed partnerships with this play-to-earn virtual world.

At the same time, Decentraland and Boson Protocol hosted the Fashion week in the last week of March. Renowned fashion brands like D&G, Esteé Lauder, and Forever 21, among others, displayed immersive experiences in the platform’s Fashion District, a virtual parcel that was bought for $2.4 million by Metaverse Group.

It’s also worth highlighting NFT Worlds’ performance, which is a virtual world made up of 10,000 NFTs that allow their owners to modify their parcels to provide gaming experiences. With its WRLD airdrop and staking pools, the project demonstrated its utility, creating a surge in demand for NFTs. NFT Worlds was the second most popular metaverse project in terms of trade volume, with $95 million in deals, after only The Sandbox ($113 million).

The possibility of a blockchain-based metaverse is rapidly approaching. Leading companies such as Microsoft, Google, Disney, Sony, and others will likely attempt to build their brands in the metaverse. However, it is critical to recognize that the ownership rights granted by NFTs, as well as the underlying financial ecosystem provided by cryptocurrencies and play-to-earn games, will move the paradigm away from the traditional metaverse, which is restricted to virtual, augmented reality.

GameFi dapps have found a way to engage their respective communities, as per DappRadar x BGA Games report Q1 2022

Splinterlands has firmly established itself as the most popular play-to-earn app. Hive’s trading card game attracted more than 366,000 daily UAW in March, up 15% from December 2021. The earnings ratio, as well as changes to the card deck supply, have helped to build a strong community around the game. The concept for the new virtual world Splinterlands has also aided the cause.

Crazy Defense Heroes (CDH) and Pegaxy, both developed by Polygon, have been among the best-selling games. CDH, a tower defense game, has steadily grown in popularity, attracting over 134,000 daily UAW in March. That’s a whopping 540 percent increase since the end of December. In the same timeframe, Pegaxy’s on-chain activity increased by 420 percent, attracting nearly 16,000 UAW in March.

Mobox from BNB and DeFi Kingdoms (DFK) from Harmony both managed to keep their on-chain metrics positive. Due to a robust plan that goes around the Momoverse, blockchain activity on Mobox climbed 10% over the previous quarter.

Despite a negative downturn in the DeFi space and a 12 percent drop in the price of JEWEL, the game’s native token, on-chain activity for DFK has remained reasonably stable. Both games demonstrate GameFi’s potential as the lines between DeFi and gaming blur.

Wax’s Alien Worlds and Binance’s Bomb Crypto, on the other hand, struggled to maintain the same degree of blockchain activity as last year. After garnering more than 300,000 daily UAW in August of last year, Alien Worlds has lost some ground.

The GameFi dapp for space mining continues to attract over 188,000 daily UAW, and its TLM token is one of the most popular game-based cryptocurrencies. Because of the history of other BNB games, such as CryptoBlades and CryptoBay, the case of Bomb Crypto is worth keeping an eye on.

While the top 10 blockchain games are primarily established, look out for other game dapps like Avalanche’s Crabada or IMX’s Gods Unchained to challenge the incumbent for the game’s blockchain activity lion’s share.

Blockchain games remain one of the most enticing aspects of the dapp industry

Although the demand for blockchain games appears to have stalled, game dapps are still driving most of the industry’s on-chain activity. Notably, the top games are still attracting their player base during a challenging Q1.

Support for a decentralized and interoperable metaverse based on blockchain games is on the verge of becoming a reality. VCs and investors are pouring money into Web3 game projects at an unprecedented rate. At the same time, major companies such as Ubisoft, Warner Bros., and Adidas are making inroads into the market.

Furthermore, major firms such as Morgan Stanley have assessed the metaverse’s economic potential to be at least $8 trillion. The second Alpha season of The Sandbox, Decentraland’s Fashion Week, and the overwhelming demand for NFT Worlds all move the sector in the right direction.

However, security issues like the Ronin bridge exploit and the challenges to achieving full interoperability remind everyone involved that mainstream adoption is still a few steps away. To get there, blockchain gaming will have to be a big part of the mix. Along with NFTs, game dapps will be crucial in gaining the widespread adoption needed to propel Web3 forward.

What do you think about this DappRadar x BGA Games blockchain gaming report Q1 2022? Let us know in the comments section below

For more Mobile Gaming news and updates, join our WhatsApp group, Telegram Group, or Discord server. Also, follow us on Google News, Instagram, and Twitter for quick updates.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones