Bitcoin and Ethereum’s combined market share has surpassed 70% during the stable second quarter, marking the first time since April 2021.

In line with this, TokenInsight’s recently published Crypto Market Insights Report 2023Q2 reveals a decrease in the overall market capitalization of stablecoins during the same period.

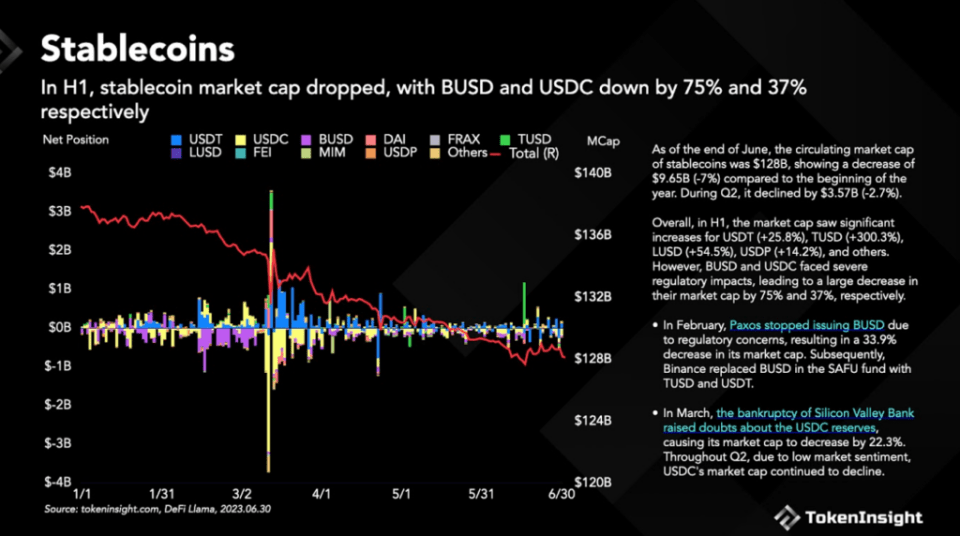

The report highlights a 7% decline in stablecoin market cap, reaching $128 billion by the end of June, for the first half of 2023.

An analysis by CryptoSlate reveals that the combined dominance of BTC and ETH has experienced a significant 12% increase, indicating that factors beyond stablecoin shifts have contributed to the growing dominance of Bitcoin and Ethereum.

The TokenInsight report emphasizes regulatory actions taken against two major stablecoins, USD Coin (USDC) and Binance USD (BUSD), as key factors driving the downward trend in stablecoin market cap. The bankruptcy of one of the reserve banks supporting USDC resulted in a 22.3% decrease in its market cap in March. Additionally, the suspension of BUSD issuance led to a significant 75% reduction in its market cap.

Ethereum Staking Surges Post Shapella Upgrade

Additionally, the report highlights the impact of the Ethereum Shapella upgrade in Q2, which has acted as a catalyst for an increase in staking. The percentage of staked Ethereum has risen from 15% to nearly 20%.

As a result of this change, there has been a significant surge in staked Ethereum, reaching a total of 23.54 million ETH by the end of June, marking a substantial 48.4% increase.

Lido, maintaining its dominant position, experienced a 32.6% growth in staked ETH, reaching 7.5 million ETH. This growth demonstrates the growing confidence in Ethereum’s vision and the potential to earn passive income through staking in the market.

LSDFi Market and Layer-2 Networks Exhibit Growth

Upon further analysis, the LSDFi (Liquidity Staked DeFi) market experienced an eight-fold surge in its total value locked (TVL), with Lybra Finance emerging as the leading LSDFi pool.

The significant growth in the LSDFi market indicates the growing integration of DeFi protocols with LSD, highlighting the expanding influence and impact of DeFi in the cryptocurrency industry.

Layer-2 networks have also shown impressive growth. Notably, zkSync, the first ZK-Rollup Layer-2 network, observed an 861.89% increase in its TVL.

This signifies the rising adoption and progress of Layer-2 solutions as the Ethereum community strives for scalable, secure, and efficient transaction processing pathways.

Bitcoin’s NFT and Transaction Spike

There were recent developments in both Ethereum and Bitcoin. While Ethereum has made considerable progress, Bitcoin observed a substantial increase in daily average transactions in May, with the number tripling since the beginning of the year. This surge can be linked to the rise of Bitcoin Ordinals such as NFTs, which led to a spike in transactions and fees.

Apart from this, crucial transformations in the crypto market are also underway. Ethereum’s staking growth, the surge in LSDFi, and the development of Layer-2 networks are some examples that could play a pivotal role in shaping the future trajectory of the crypto market. Moreover, you can download the complete TokenInsight report from its website.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones