Have you ever noticed the number of times you use your credit card or digital wallet to make a transaction?

Well, let’s say it’s 2-3 times a day if that was me. Gone are the days when customers hand out money at every other store to pay for something they buy. The sole reason behind this is how the present payment systems work around the globe.

Recent technological advancements have also given birth to huge disruptions in various markets, and the ripple effects can also be seen in the payments industry.

All of us have witnessed the journey of payments through cash, cheques, credit/debit cards, card taps, and finally, the most exciting method – the digital wallet.

The usage of digital wallets grew exponentially during the pandemic when traveling to places to make payments was not possible.

We, as customers, could easily pay right from our phones to place an order conveniently.

This also increased the purchasing power in the hands of the people. All in all, is it a blessing in disguise? Let’s find out everything about digital wallets in this post.

What is a Digital Wallet?

A digital wallet is an electronic version of your regular wallet. Just like your physical wallet, you carry your credit/debit cards and money in your virtual account to pay merchants via an online form of payment.

Your bank details and credit card information are stored securely, and you can make payments with a single tap. This means you don’t have to carry your checkbooks or a physical copy of your credit/debit cards every time you need to make a transaction.

However, it doesn’t end here. You can also make payments from your digital application for flight/bus tickets, movie tickets, gift cards, hotel reservations, gas and electricity bills, etc.

Some wallets even allow you to store your driver’s license, car keys, and identification card details in your digital wallet.

Moreover, you can check your fund balance and track payment histories from your e-wallet. They can be generally used from your mobile bank application or via third-party digital wallets such as Google Pay, AmazonPay, PayPal, and others.

How Does a Digital Wallet Work?

The working mechanism of digital wallets is simpler than you think.

The first step is to activate them on your mobile phone by entering the necessary details and setting up an authentication method to access your wallet. This can be a secure pin, fingerprint, or face lock.

You can be assured that your sensitive information stored in the e-wallet is completely secure and encrypted.

Digital wallets usually employ various technologies to initiate different forms of payment. The widely used methods are:

#1. QR Code

The most popular of all, a Quick Response (QR) code, is a matrix code that stores user information. Using a QR code, you can send or receive money by simply scanning the QR code of the user.

This is one of the most frequently used methods, as it is quick, easy, and initiates payments within seconds.

#2. Magnetic Secure Transmission (MST)

Have you observed the chip on your credit or debit card, which allows you to make payments with a single tap technology?

Well, this is possible because of secure magnetic transmission. Similarly, your mobile phone creates this magnetic field and has an electronic chip that can be used to make payments when you tap that chip from your phone to the payment booth.

#3. Near Field Communication (NFC)

NFC is a wireless technology generally used to transfer files, data, and other information when the devices are placed close to each other.

This method uses an electromagnetic signal to establish a strong connection between the two devices.

In addition to the technologies mentioned above, you can also make payments via a payment link sent by the vendor. You simply have to click on the link and enter your necessary details to initiate the payment.

Some of the wallets also allow you to include your crypto card details and let you pay via cryptocurrency, which in my opinion, is pretty cool.

Also read: Best Payment Processing Solutions for Your Online Business

Different Types of Digital Wallets

There are 3 different types of digital wallets that are mostly used worldwide. Let’s dive into them in detail.

#1. Closed Wallet

A closed wallet is created by businesses that sell products or services to their customers. You can use the funds stored in the wallet with the issuer of the wallet.

If in case a transaction is left incomplete or there are any refunds, the money is credited back to the source of payment. A classic example of a closed wallet system is Amazon Pay.

#2. Semi-Closed Wallet

With a semi-closed wallet, you can make transactions with listed merchants and locations with the help of a shared key or a password to process the transaction.

In this process, the user data is saved in a centralized system for safety purposes, and you can use this method offline and online.

While this wallet does have a limited coverage area, it does give you the ease of usage by using multiple public keys while keeping private keys offline.

#3. Open Wallet

The easiest and the most famous open wallets are linked with banks and can be accessed from any part of the world.

It offers you the flexibility to transfer funds easily, and you can access an open wallet from your mobile or even a web browser.

They are compatible across all platforms and allow you to track your transactions. In addition to this, you can also withdraw funds from an ATM with the help of an open wallet.

Examples of Prominent Digital Wallets

It’s possible that most of us are existing users of a digital wallet. However, if you’re starting with it, here are some of the most prominent digital wallets you can start your e-wallet journey with. These are also great examples of how digital wallets operate.

#1. Apple Pay

A literal favorite among Apple users, Apple Pay, is a private payment method that’s faster and easier than using cards or cash. You can use Apple cash to send money to your friends, pay bills, or make in-app purchases for your favorite apps.

Apple Pay is in-built into major Apple devices like iPhone, Apple Watch, Mac, and iPad, and you can set it up within seconds.

The best part? Apple Pay is compatible with millions of websites and apps you use daily.

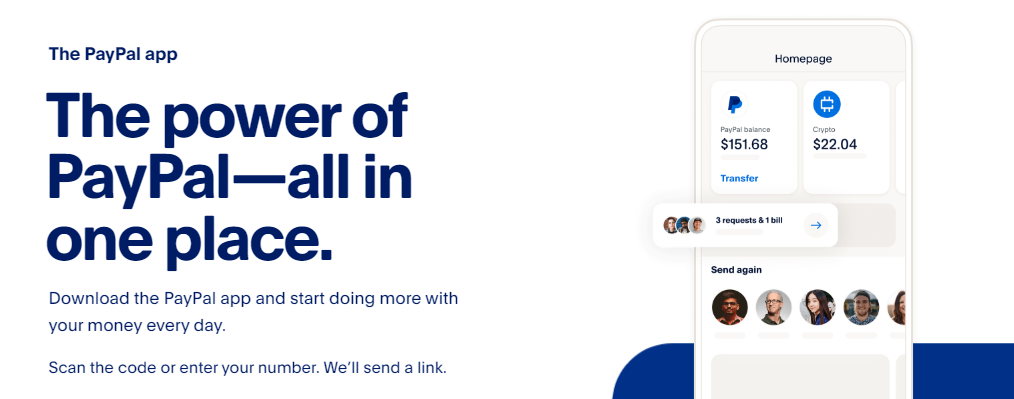

#2. PayPal

PayPal is one of the most known e-wallets in the professional community. A lot of companies use PayPal as a major form of payment to employees and freelancers working abroad.

This digital wallet can be accessed from your mobile, desktop, tablet, and anywhere with a browser.

You can also add your Mastercard to PayPal and make cardless payments with a single tap wherever PayPal is accepted.

It’s also a treat to use the PayPal app, as it has an intuitive interface and a simple and secure sign-up process.

Again, this is one of the most used payment apps out there, as many merchants use it and process payments through it.

Also read: How to Cancel a Payment on PayPal

#3. Amazon Pay

A unique closed digital wallet, Amazon Pay allows users to purchase products from Amazon and, at the same time, also streamlines payments for local businesses listed on Amazon.

Additionally, you can pay your mobile, gas, and electricity bills and receive a reward or cashback for every transaction you make.

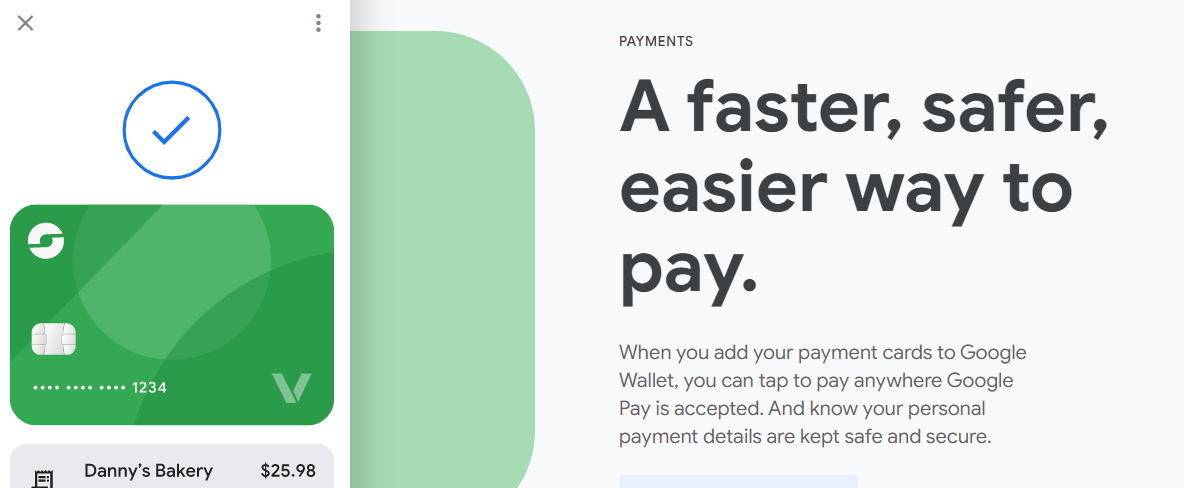

#4. Google Wallet

With Google Wallet, you can tap to make payments wherever Google Pay is accepted, use loyalty cards, book a flight, get a concert ticket pass, and more by just using your phone.

It comes with a 2-step verification process to secure your data and lets you choose the information you wish to share for a more tailored experience.

When it comes to flights, the app notifies you in case your flight details have changed.

#5. Samsung Pay

Used by Samsung users, Samsung Pay is a simple and easy-to-use digital wallet that initiates payments in three easy steps:

- Open the application and swipe up

- Authenticate

- Tap your phone to pay

For enhanced security, the app can be accessed using an Iris scanner, fingerprint, or pin authentication. The best part about this wallet is that even if you’ve lost your phone, the card information is still safely encrypted in a secure data vault.

As a side note, I know choosing the right digital wallet for your needs can be confusing. Here are some tips which can help you make the right decision:

- Ensure that your digital wallet is safe and secure to use and store data

- Always know if the wallet is a closed, semi-closed, or an open wallet

- Research a lot about the pros and cons of the app you wish to go ahead with

- Check if there are any additional charges that may incur while using the wallet

- Read the application reviews thoroughly

- Always read the terms and conditions before signing up for the digital wallet service

- Make sure you download a digital wallet from the official source only

Next, we will explore how to use a digital wallet.

How to Use a Digital Wallet?

Setting up a digital wallet can be done within the blink of an eye. Depending upon your digital wallet, simply open the digital wallet installed on your device and enter your credit card or debit card details, and you’re done.

You can sit back and relax, knowing that nobody can open and access your digital wallet except you. The wallet will always require authentication before it directs you to the dashboard and the payment.

Benefits of Using a Digital Wallet

The advent of the pandemic did skyrocket the use of digital wallets in our daily lives. However, this does not rule out that they have their own long-standing merits, which cannot be disregarded.

Here are some of the many benefits of using a digital wallet:

#1. Safe and Convenient

They store all of the information safely in a compact form that rules out the need to carry your physical wallet everywhere.

#2. Saves You Time

Digital wallets have streamlined and expedited the entire checkout process.

You don’t have to fill out forms or stand in long queues. Just pay for your products, and they will be delivered to your doorstep.

#3. Serves to a Wider Audience

You do not need to go to a bank to store your information – it’s all digital. This helps people in rural areas to have their digital wallets.

Not to mention, many developing countries are now using digital wallets to increase their participation in global markets.

#4. No Stress of Losing Physical Copies

When it comes to e-wallets, they are safer than physical wallets. You won’t have to worry about losing them.

Besides, authentication is always required before operating a digital wallet.

#5. Seamless Overseas Money Transfer

It allows the transfer of funds to your friends and family who reside overseas.

#6. Provides Valuable Insights

Digital wallets help companies with real-time valuable customer insights on their purchases, preferences, etc., which can help develop marketing trends and targeted marketing campaigns.

#7. No Minimum Balance Requirement

There’s no minimum balance requirement for a digital wallet, and no penalty will be charged if your balance goes to zero.

#8. Multiple Transactions From One Place

You can perform multiple transactions from one place to purchase goods, pay your bills, book your flight tickets or pay your medical expenses.

#9. Users Get Exciting Rewards

Best of all, you usually get cashback, vouchers, and gift cards whenever you make a payment using the digital wallet.

Are Digital Wallets Safe to Use?

The answer is a big YES! All thanks to encryption and tokenization, your information and transactions are safe and secure.

To explain, technically, when you add your data, it gets converted into encrypted codes that can only be accessed by authorities.

This is further layered with tokenization which replaces your sensitive data with non-sensitive code known as a token that further matches only with your merchant’s token, which is when the transaction takes place.

Also, these tokens are randomly created every time you make payments, which means your information is useless to fraudsters.

Additionally, your e-wallets are always topped with manual layers of authentications like pins, fingerprint locks, face locks, iris locks, etc.

Digital Wallets Vs. Crypto Wallets

As we discussed, digital wallets are used to store and transfer money. On the other hand, a crypto wallet is used to store the keys that are used to buy and sell cryptocurrencies.

Ultimately, they don’t hold any currencies but give you the tool to access them. To simplify, crypto wallets are used to buy and sell cryptocurrencies.

However, it also allows you to pay in crypto wherever the merchants accept them. When compared to a digital wallet, crypto wallets offer less in functionalities.

Cons of Using a Digital Wallet

Let’s face it; every coin has two sides. We looked at the numerous benefits of using a digital wallet. Let’s now be transparent about the cons it brings along with itself.

#1. Breach of Privacy

As consumer data is constantly tracked for market research and to understand purchasing trends, this also means a breach of privacy for users making transactions using digital wallets.

#2. Limited Reach

While this technology is being widely used, when it comes to local stores, many small shop owners have yet to adapt to it. This, therefore, creates a restriction to using e-wallets everywhere you go.

#3. Device Dependency

A digital wallet is widely used on mobile phones. This also means if you misplace it, you won’t be able to access your digital wallet. This can be an inconvenience, especially if you urgently want to purchase something and do not have cash.

Resources

While this post has covered almost everything you need to know about a digital wallet, there’s always much more you can learn and adopt for better practice.

To do this, you can read Digital Wallet: A Complete Guide to help you better understand the entire ecosystem.

This book contains some commonly faced problems and their solutions, along with a detailed process on how to go about handling everything with a digital wallet.

Moreover, it has a lot to offer, including:

- A self-assessment test that will help you ask the right questions and, thus, improve the functioning of a digital wallet

- Implement and integrate recently developed technologies and designs in this space according to best practice guidelines

- It helps you diagnose digital wallet processes, initiatives, organizations, businesses, and more using the accepted diagnostic standards and practices

You can order this book in paperback format and kickstart your digital wallet journey with a bang! 💥

Author’s Note

Digital wallets are safe, secure, and a great addition to the payments industry. They are already revolutionizing the customer experience by providing an efficient, fast, and secure payment method with great convenience.

Remember, it’s always very important to know the type of digital wallet and service you’re opting for because one wrong decision can lead to money and identity thefts without you knowing what has happened.

We know that physical wallets will always be used, but digital wallets have elevated our lifestyles considerably.

Next, check out these amazing split bill apps to track shared expenses.

Si quiere puede hacernos una donación por el trabajo que hacemos, lo apreciaremos mucho.

Direcciones de Billetera:

- BTC: 14xsuQRtT3Abek4zgDWZxJXs9VRdwxyPUS

- USDT: TQmV9FyrcpeaZMro3M1yeEHnNjv7xKZDNe

- BNB: 0x2fdb9034507b6d505d351a6f59d877040d0edb0f

- DOGE: D5SZesmFQGYVkE5trYYLF8hNPBgXgYcmrx

También puede seguirnos en nuestras Redes sociales para mantenerse al tanto de los últimos post de la web:

- Telegram

Disclaimer: En Cryptoshitcompra.com no nos hacemos responsables de ninguna inversión de ningún visitante, nosotros simplemente damos información sobre Tokens, juegos NFT y criptomonedas, no recomendamos inversiones